By Kevin Theissen

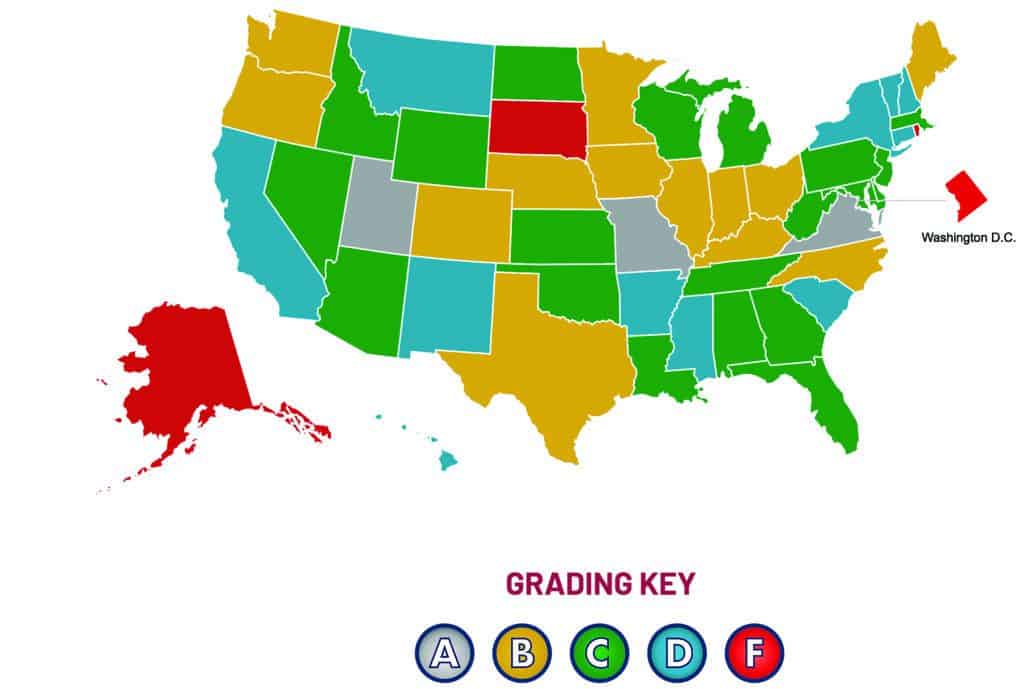

The American Public Education Foundation recently found that Vermont schools are woefully short in helping prepare students to be financially literate. With a grade of “D,” many students are not learning to handle their finances smartly, avoid debt, better understand the economy and learn to make good decisions about their life and money.

Through the group’s Vision 2020 Report Card, they are putting a nationwide spotlight on financial education in the classroom. The report showed that Vermont had very limited accomplishments. The state requires high school financial literacy instruction, adopted Jump$tart K-12 Financial Literacy standards; and provides financial literacy resources.

The report reviewed the standards adopted by the Vermont State Board of Education. The Financial Literacy standards are addressed but acutely deficient. For example, one of the required curriculum areas is Global Citizenship, which includes economics but not financial literacy.

Furthermore, even though Jump$tart was adopted for K-12 in 2018, there are no guidelines for its implementation. How the standards are accomplished is locally determined. The standards can be met in social studies, math, business, family and consumer science, and through flexible pathways. Currently, only 13 of Vermont’s 55 supervisory unions/supervisory districts require Financial Literacy as a graduation requirement.

As a result, because Vermont only guarantees minimal financial literacy instruction through leaving implementation mostly up to the local district’s discretion (which has been terribly inadequate and with no direction), Vermont receives a “D” in financial literacy instruction. Vermont should require that schools implement the adopted Jump$tart standards and require a stand-alone personal finance course for high school graduation in order to improve its grade.

Nationwide, Vermont is one of only 11 states that received a “D” and only four states were worse by receiving an “F.”

Kevin Theissen is the owner of HWC Financial in Ludlow.