Dear Editor,

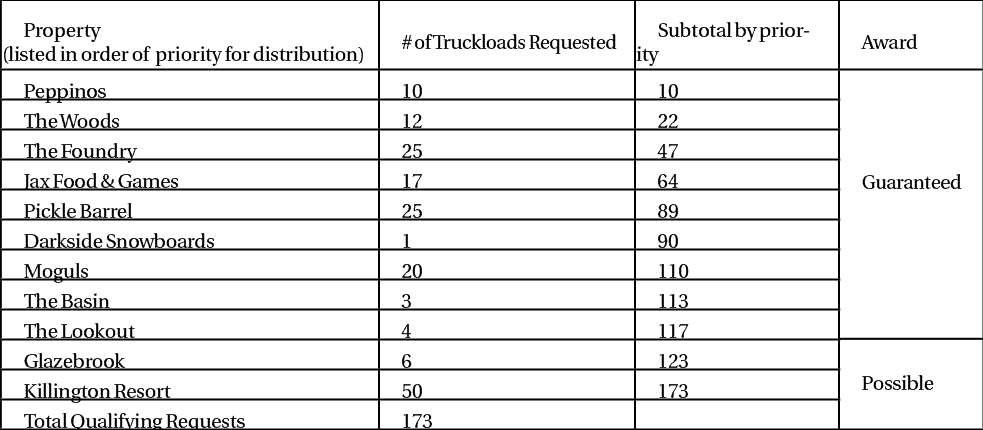

On Friday, June 11, I received an email notice of the awarding of excess millings from the repaving of Killington Road with the following chart.

I thought a lottery was supposed to take place if there were not enough millings to go around? A town notice clearly stated: “If we do not have enough material to fulfill qualified response we will hold a lottery.” When did this lottery take place? Or did it? To me it looks like none did and the businesses were prioritized by distance from the job site. (See chart above.)

There seems to be something inherently unfair in the distribution of these millings.

First of all one business owner gets 67 truckloads (The Pickle Barrel, Jax and Foundry are all Chris Carr’s businesses.) You would think a more equitable distribution would have been adopted.

Second, not a single resident qualified.

Third, it was stated in the milling program memorandum recipients were prioritized in part, “in order to limit trucking.” I requested three truckloads and am closer than all recipients except for Peppino’s and The Woods to the actual source of the millings, thus there is an increased expense to move those millings to favored recipients. I wonder how many other residents and or businesses were denied because they did not have “driveway access to Killington Rd.” but are closer than the awardees to the job site.

I realize that the program stated only Killington Road businesses and residents, but that was an arbitrary decision by the town manager to begin with.

It’s not only the Killington Road property owners that are paying for this road, all taxpayers are — this program should include all residents if not all taxpayers.

I would hope this program is modified include all taxpayers because right now it is brazenly favoring businesses.

Vito Rasenas, Killington