By Curt Peterson and Polly Mikula

Two local towns, Killington and Woodstock, currently have short-term rental regulations and now the state Legislature seems to be interested in joining the fray.

Bill H.200, introduced by Representatives Kornheiser (Brattleboro), Colburn (Burlington) and Pajala (Londonderry), claims four purposes: Protecting the residential rental market, supporting full-time residency, discouraging real estate speculation, and leveling the playing field for short-term rentals and other types of lodging.

A “short-term rental” is defined as any sleeping accommodation that is rented in exchange for a fee for less than 30 consecutive days.

Both Jim Haff, Killington selectman who supported the town’s short-term rental regulations, and Dave McComb, owner of Killington Vacation Rentals, who didn’t, told the Mountain Times H.200 seems superfluous.

“The state Legislature just gave local cities and towns the clear ability to regulate short-term rentals through ordinance,” McComb said, which is what Killington and Woodstock have done. “That is the approach that each locale should be taking.”

In fact, on Feb. 23 Town Planner Preston Bristow reported to the Killington Planning Commission that 436 short-term rental registrations had been processed, and $84,000 in registration fees had been collected, as part of Killington’s recently instituted short-term rental registration program. Another 188 owners/managers were sent 15-day reminder notices on Feb. 15, of which 42 had been answered.

The Killington program provides a complaint process — mostly aimed at over-occupancy, tenant noise and parking spillover. Bristow said five noise complaints had been submitted through a hotline and all were followed-up the next day.

“My question is, why do these legislators believe they need to step in?” asked Haff. “I believe the situation will be better handled by each town as a zoning issue, as the state already allows.”

State Representative Jim Harrison told the Mountain Times H.200 has been referred to the House General, Housing and Military Affairs Committee, but no action has been taken.

McComb noted that the same bill was introduced in 2020, but was not considered then. “I’m not sure why it has generated so much news this year,” he said.

Section 4469 of H.200 intends to prevent absentee landlords from converting otherwise usable permanent residences for short-term rental income: “A person may not offer all or part of a dwelling unit as a short-term rental unless the person has occupied the dwelling unit as his or her primary residence for: 1) 270 days of the preceding year, or 2) if the person has owned or leased the dwelling for less than a year, more than 70% of the days that the person has owned or leased the dwelling unit.”

There is an annual $130 state registration fee per short-term rental unit in H.200. Killington’s registration fee ranges from $150-$250, determined by number of bedrooms.

“I’m not a lawyer,” Representative Harrison said, “but the residency requirement may [raise] constitutional questions.”

It would certainly put multiple short-term rental enterprises out of existence.

Other than the residence requirement and the fee schedule, H.200’s health, water, sewage and safety requirements mirror those in the Killington ordinance.

Airbnb and VRBO — the largest two platforms in the short-term rental industry — have notified their clients of this potential change in Vermont and there are petitions circulating to oppose the bill.

“The Vermont Legislature is considering legislation to severely restrict short-term vacation rentals,” VRBO wrote to its property owners. “H.200, sponsored by Representative Emilie Kornheiser, seeks to impose a primary residency requirement for all short-term rentals in Vermont… If this bill passes, you would not be able to use a property as a short-term rental unless it is your primary home!”

The Vermont Association of Realtors has also spoken out against the regulations: “The bill, as introduced, has the potential to eliminate the short-term rental of second homes, condominiums and any property other than a primary residence…. we will be watching this closely.”

In response to this legislation, a group of Vermont short-term rental stakeholders has formed the Vermont Short-Term Rental Alliance (VTSTRA), a coalition advocating for the legal protection of short-term rentals in Vermont.

In addition to H.200, two other twin short-term rental bills that have been introduced: in the House, H.257 (first introduced in 2020) was reintroduced mid-February and would create a rental registry that includes short term rentals. In the Senate Housing and Economic Development, S.79 was introduced at the same time with the same language.

State Senator from Windsor County Alison Clarkson told the Mountain Times, “[S.79] is about rental housing health and safety, creating a rental registry for all rental housing (short- and long-term) and creating a Vermont Housing Incentive Program to encourage landlords who own blighted or vacant rental properties to bring them up to code, weatherized and back online … we need as many affordable rental properties as possible.”

While VTSTRA opposes H.200, the coalition supports “a statewide system for short-term rental registration.” As well as “the enforcement of health and safety standards in order to protect the wellbeing of hosts, guests, neighbors, and communities.”

“It is far more likely that the House Committee on General, Housing and Military Affairs will take up the Chairman’s bill, (H.257) to address rental properties in Vermont,” according to the Vermont Association of Realtors. “We will continue to monitor H.200, but we anticipate that progress on a rental registry will develop in H.257 and S.79.”

The Vermont Association of Realtors “is prepared to provide comments when the bills come before their respective committees,” the organization stated.

First, the bills need to be reviewed and voted out of committee and onto the House floor. Then they can be sent to the Senate for their review. This “crossover” date will likely take place on March 12.

Economic impact

Nights rented at short-term rentals are subject to Vermont’s 9% Rooms and Meals Tax as well as local option taxes and must be remitted to the Vermont Dept. of Taxes if the total number of nights rented is more than 14 per property in one calendar year.

While there is no accurate data on how many short-term rentals are in Vermont, in 2018 Airbnb remitted $7.8 million in rooms and meals and local option tax revenues to the state of Vermont. Douglas Farnham, deputy commissioner of the Vermont Dept. of Taxes, estimates that Airbnb captures 50% of the short-term rental market — meaning the total tax benefit to the state is over $15 million.

The income is also a significant — and sometimes crucial — to the owner of the short-term rental, too. Arbnb reports that 55% of its hosts say that hosting has helped them afford their homes.

“That is absolutely true for me,” said Andrea Weymouth, a young professional and an owner of multiple condos in Killington. “Short-term rental income helps me afford my condo and provides a bit of extra income for my family.”

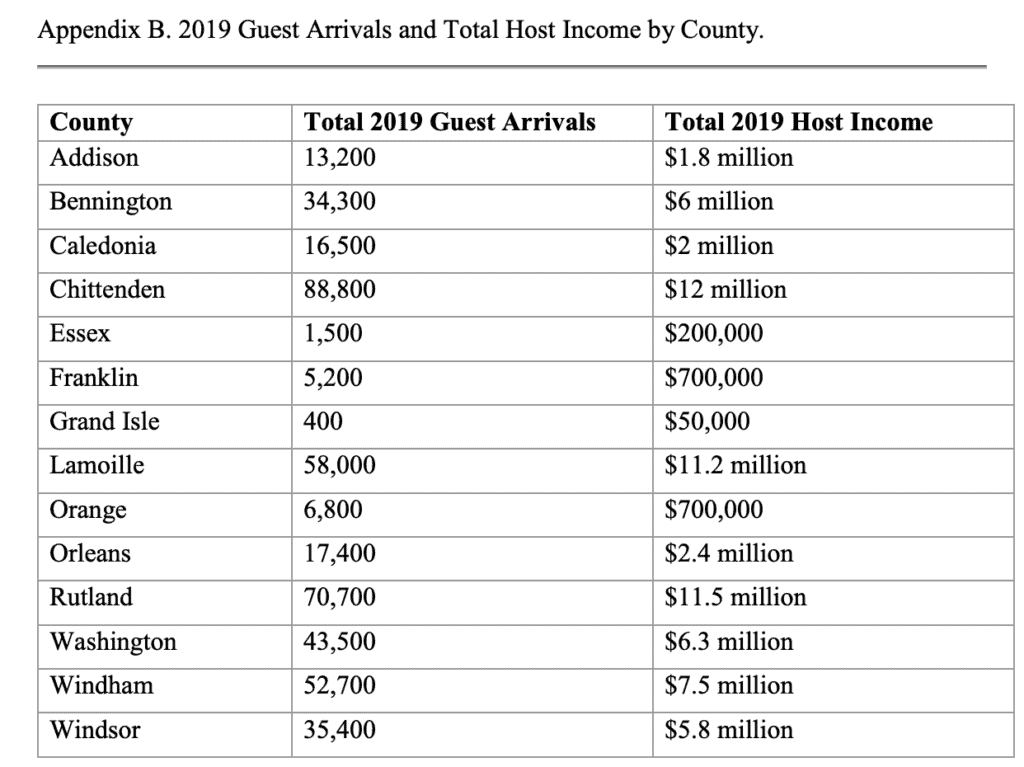

According to Airbnb, Chittenden County hosted the most guests in the state in 2018 with 72,300, generating $9.1 million in host income. Rutland County (which includes Killington) was second with 51,400 guests generating $7.9 million in income for hosts. Stowe is third with 330 hosts.

Additionally, according to VTSTRA , on average Airbnb guests say 41% of their spending occurs in the neighborhood where they stay, further benefitting host towns tourism economy more broadly.

A 2020 report titled “Short-term rental units: Regulations and impacts in Vermont policy, options to address the uneven playing field,” published by the Nelson A. Rockefeller Center at Dartmouth College, agreed concluding that “short-term rentals contribute positively to the Vermont tourism industry.”

State or local control?

“Within Vermont, there exists a range of local regulation on short-term rentals,” the Dartmouth College report continued. “Some areas have a higher concentration of units and, as a result, regulate more strictly. These areas include Killington, Stowe and Burlington.”

The report went on to outline the specific policies in each of those three communities. [Editor’s note: The Mountain Times includes the policy in Woodstock, too, for local comparison.]

Killington

In January of 2020, the town of Killington Planning Commission passed new zoning bylaws pertaining to short-term rentals. They state that a short-term rental qualifies a building as a “public building” and makes it “subject to the jurisdiction of the state of Vermont Division of Fire Safety.”

Units with a capacity greater than eight occupants are required to obtain a Public Building Permit from the State of Vermont Division of Fire Safety. Smaller units can use a self-certification form instead.

Short-term rental owners must register and pay a fee based on the number of bedrooms in the unit, are also required to provide proof that the liability insurance. Once satisfied, hosts will receive a zoning permit for short-term rental.

Stowe

In Stowe, single-family homes, condominium units, and apartments are permitted to be rented if the rental is for one week or longer. Rentals for less than that are considered to be lodging facilities and are only permitted within certain zoning districts. Any house may be converted to a bed and breakfast, but that requires the owner or a permanent occupant to live there. Inspections are required and include code compliance in regards to egress windows, smoke and carbon monoxide alarms, stairways, and handrails. The current cost for an inspection is $125. Additionally, hosts will need insurance to cover damage and liabilities for short term renters.

Burlington

The more urban nature of Burlington differentiates it from other high-traffic tourist regions in Vermont. The city is currently in the early stages of short-term rental regulation. Ordinances have not yet been enacted, but there is a proposed framework. The city plans to differentiate between individual rooms rented out within a larger unit and entire units being rented. Homes with one or two rented bedrooms would be exempt from a registration requirement.

In residential districts, one parking space would be required for each rented bedroom or whole unit. The proposal includes expanding the current bed and breakfast zoning standards to apply to short-term rentals. It also suggests limiting the number of whole-unit rentals per building. These zoning regulations would not apply to units rented less than 10 consecutive and 30 total days in any 12-month period.

The most significant proposed regulation would require that hosts be a resident of the property of the rental unit. With regulation, the city aims to increase the housing stock available to Burlington residents.

Woodstock

The Woodstock Select Board approved short-term rental regulations on Jan. 21, 2020. They require owners of short-term rental properties to register and pay a short-term rental fee of $115 per property, plus $100 per guest room.

They also limit the number of times in a year the short-term rental may be rented to 10. If the owner occupies the building while it is being rented, the limit is 15.

Owners in five-acre residential and short-term rental zones may rent 15 times per year, with a two-night minimum. If the owner occupies the building during the rental, it is exempt from all short-term rental limits.

Other requirements for a short-term rental permit include satisfactory fire safety inspection by Woodstock’s fire chief, a two-persons per bedroom occupancy, six-person maximum per household, adequate legal parking, rubbish removal, posted notice of rules regarding rubbish, parking and noise.

The regulation prohibits “weddings, parties, catered events…and outdoor activities between 9 p.m. and 7 a.m.”

The owner or a manager and contact information must be identified and be available within 30 minutes at all times.

The penalty for violating a regulation is a fine of $200 per day per violation.

Local regulation, state registry

Due to the differences between communities, their make up, and unique challenges, the Dartmouth College report states: “Policies that are a good fit for Burlington may not be practical for the rural parts of the state. The tourism market in towns like Stowe and Killington may be more competitive than in other less resort-inclusive towns. It is worthwhile for the state to look at the policies proposed or already in place in these localities and selecting certain components of them is definitely feasible. However, it is important that they keep in mind similarities and differences between these small geographic areas and the state writ large. Vermont is leading the way for statewide legislation to address short-term rental units. An option remains to decentralize the approach and have municipalities implement the conditions that best fit their local context.”

The report concludes: “Short-term rentals contribute positively to the Vermont tourism industry. Guests who use intermediaries like Airbnb and VRBO patronize local businesses, such as restaurants, and contribute to secondary revenue streams for their hosts. Short-term rentals are not regulated like the traditional hotel and restaurant industry. An agreement between Airbnb and the Vermont state Legislature allows the intermediary to remit Meals and Rooms taxes. However, the state does not possess a comprehensive list of short-term rentals. This creates challenges around health and safety regulation and additional taxation.”