The Vermont League of Cities and Towns (VLCT) released an independent analysis of Vermont’s Tax Increment Financing (TIF) program Tuesday, April 19, that concluded that TIF helps Vermont meet its smart growth goals, promotes long-term planning, and contributes to net-growth in the Education Fund. The report comes as the Vermont Legislature considers expanding TIF to smaller, rural communities through “project-based TIF.”

TIF growth in valuation exceeds the background growth rates. This demonstrates that the state unquestionably sees both a positive cash flow coupled with the promise of future revenue assessed against those higher levels of valuation, according to the 2022 Joint Fiscal Office.

“VLCT commissioned the report to evaluate if the TIF program was meeting its intent of spurring development and growing tax revenues,” said VLCT Executive Director Ted Brady. “The findings of the analysis support the continued use and expansion of the program. In short, it’s advancing our codified development goals, encouraging communities to think long-term, and growing our tax base.”

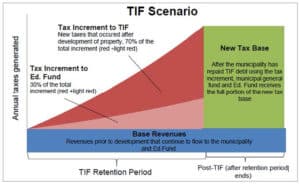

Brady explained that Vermont’s TIF law allows municipalities to incur debt to make public infrastructure investments and repay that debt with a portion of the increased property tax revenue sparked by the new infrastructure.

There have been 12 cities/towns that have used TIF to spur development, thus far. They include: Newport City, St. Albans City, Burlington (two TIFs (Waterfront and Downtown), South Burlington, Winooski, Milton Town, Milton North/South, Montpelier, Barre, Killington, Hartford, Bennington.

(Locally, Killington hopes to be approved by the state as a TIF district in the next few months, see related story, and Rutland City is in the beginning stages of evaluating the option as well.)

South Burlington City Manager Jessie Baker said: “In the six years studied by the University of Wisconsin research team, Vermont’s TIF program paid for $180 million in public infrastructure in 12 TIF districts, generating nearly $685 million in development, nearly 4,000 jobs, and a 68% increase in property tax revenue for the Education Fund. The research team found that the Education Fund would be smaller if not for our state’s TIF districts.”

VLCT hired the Hartland, Vermont-based Rural Innovation Strategies (RIS) to complete the analysis. RIS partnered with the University of Wisconsin Oshkosh Center for Customized Research and Services.

Johnson Select Board Member Eric Osgood said he hoped a proposed project-based TIF pilot program in the Senate-passed version of H.159 would become law this year. The proposal would allow municipalities to apply to the Vermont Economic Progress Council (VEPC) for a relatively smaller TIF of up to $5 million to build public infrastructure in a designated growth area or an industrial park.

Osgood said: “Johnson would be hard pressed to use the existing TIF program. As a Select Board member for a small rural community, I welcome the changes in H.159 that would right size the TIF program and TIF requirements so that Johnson and other rural communities could have the same access to capital that the bigger communities in Vermont have had for nearly 40 years.

To read the full report, visit: vlct.org.