Act 127’s new weighting formula, allows up to 10% increase with 5% cap on the equalized tax rate;

rising property values aren’t capped

By Curt Peterson and Polly Mikula

Courtesy Ben Ford, MVSU

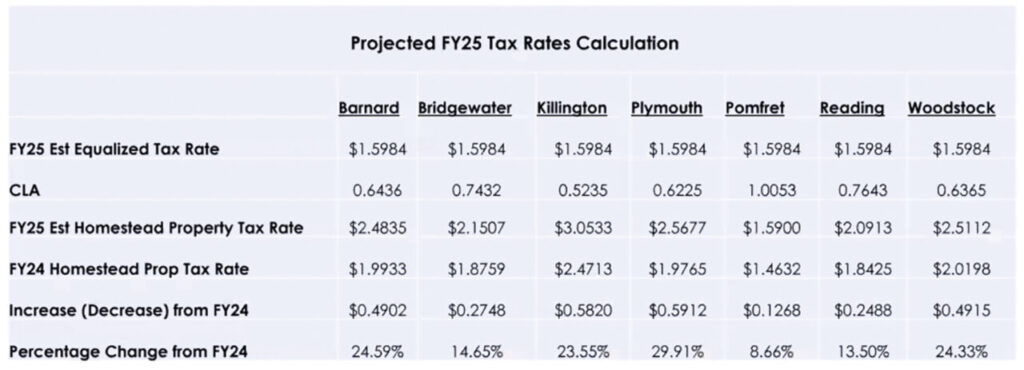

The chart above show the projected FY25 tax rates for each district town; the $1.5984 rate in the first row is the 5% capped rate per Act 127; the CLA is a factor to estimate real property values.

The Mountain View Supervisory Union (MVSU) board approved a proposed district school budget of $30,429,153 for FY2025 at their board meeting Monday, Jan. 8. The school district budget (Article 6) will be on the ballots of the seven towns that make up the district — Barnard, Bridgewater, Killington, Pittsfield, Pomfret, Reading and Woodstock — on Town Meeting day, March 5.

Despite this year’s budget increasing $4.6 million, or 17.8%, over last year, “the equalized tax rate will increase by a flat 5% from FY24 to FY25 due to the application of a cap going into effect with Act 127 (new pupil weights),” Ben Ford, chair of the finance committee presented at the board meeting.

Act 127 allows districts that keep to under 10% over last year’s per pupil cost to pay an increase of only 5% for the next five years.

Under the new weighting formulas — designed to more accurately reflect the true cost of educating students at different ages and demographics — the state calculated the Long Term Weighted (LTW) students (new term) to be 1,520 students this year vs. 918 last year under the old weighting formula.

Weighting factors apply differently per grade level, poverty, sparsity (rural populations), learners of English as a second language, and size of school. The base rate for the weight also changed drastically under Act 127. Before the weighting was applied to $15,479 per student; now it’s $9,452.

Up to 10% ‘free’

Because there is no direct local tax rate increase as long as the district stays under the 10% threshold, according to Act 127, districts can spend right up to that point and still receive the cap of 5%. Thus, the MVSU board voted Monday night to include paying off $750,000 of its debt, as doing so still keeps the budget under the 10% threshold.

“We have an opportunity to reduce capital debt ahead of schedule with no impact to tax rates in FY25,” Ford explained.

That budget ($30,429,153) minus local revenues (estimated at $4,515,121) gives the district its education spending ($25,914,032), which is then divided by this year’s 1,520 LTW students for the per pupil cost of $17,048 and an equalized tax rate of $1.81 before the cap.

Last year, while the budget was lower at $25,836,048, the per pupil cost was much higher at $23,135 — but the new formulas make any comparison tricky.

CLA increases taxes

The per pupil spend divided by the property yield equals the equalized tax rate, which is then divided by each town’s Common Level of Appraisal (CLA) to get each town’s tax rate.

While the equalized tax rate is capped at a 5% increase, the CLA is not capped — and is responsible for most of the increase district towns will see. Increases range from 8.66% in Pomfret (which recently did a reappraisal) to a 29.91% increase in Plymouth. Barnard, Killington and Woodstock will also see increases over 20% (see chart above).

“We’re seeing massive appreciation in property values, which is what the CLA is based on,” Ford said.

The lower a town’s CLA, the larger the adjustment in the property values that is applied to their tax rate. Killington’s CLA is lowest at .5235. This means for a Killington property valued on the Grand List at $500,000, the CLA adjusted taxable value is about $952,000.

New build?

In addition to the budget, district voters will be asked to approve Article 7, a bond for a new school. The bond article says it will not exceed $99 million to finance construction of a new union middle/high school on the site of the existing school in Woodstock. The bond would also cover athletic field reconstruction and the demolition of the existing structure.

While state school construction aid has been suspended since 2007, the district “intends to use other state funding such as available tax capacity resulting from the implementation of new pupil weights under Act 127 of 2022 and amounts raised through private fundraising” to limit financial impacts of the bond for taxpayers.

Ben Ford told the school district board members Monday night that the square foot cost of the proposed project was $627/square foot, which is under the revised state standards and lower than five other recent/current school construction projects in Vermont.

Ford will be attending Select Board meetings in district towns in the coming weeks to inform the public about the plans and answer questions. That schedule is as follows:

Plymouth

Tues, 1/16/24 @ 6pm

Municipal Building Meeting Room (68 Town Office Road Plymouth, VT) and via zoom—link located at plymouthvt.org

Pomfret

Wed, 1/17/24 @ 7pm

Pomfret Town Office (5218 Pomfret Road Pomfret, VT) and via zoom—link located at pomfretvt.us

Killington

Mon, 1/22/24 @ 6:30 pm

Killington Public Safety Building (800 Killington Road Killington, VT) and via zoom—link located at killingtontown.com

Barnard

Wed, 1/24/24 @ 6pm

Barnard Town Hall (115 North Road Barnard, VT)

Reading

Mon, 2/12/24 @ 6pm

Robinson Hall Dining Room (Reading Town Hall, 799 VT-106 Reading, VT) and via zoom—link located readingvt.govoffice.com

Woodstock

Tues, 2/13/24 @ 6 pm

Woodstock Union Middle and High School Library (100 Amsden Way Woodstock, VT) and via zoom—link located at mtnviews.org

Bridgewater

Tues, 2/27/24 @ 4:30 pm

45 Southgate Loop-Selectboard Room Bridgewater, VT and via Zoom at bridgewater.vt.gov