By Katy Savage

The local housing market picked up considerably after a slow start to 2024.

Limited inventory remained a major driving factor with the total number of units sold up slightly by 1.9% across Rutland County and slightly down in the Upper Valley -3.5%, according to a regional analysis by Sotheby’s International Realty. Additionally, the average sales price increased by 9.7% in Rutland County and by 8.4% in the Upper Valley, and the average days on market decreased by 7.1% in Rutland County and increased by 4.3% in the Upper Valley.

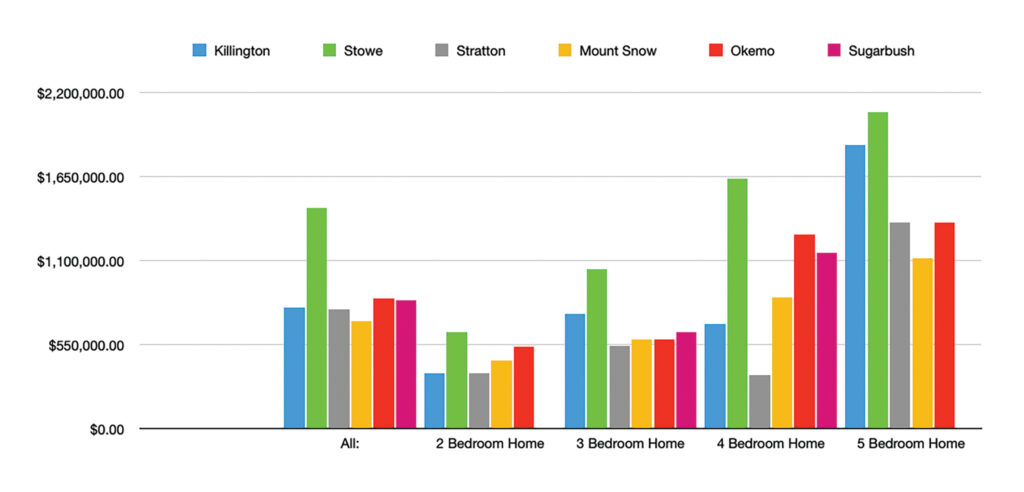

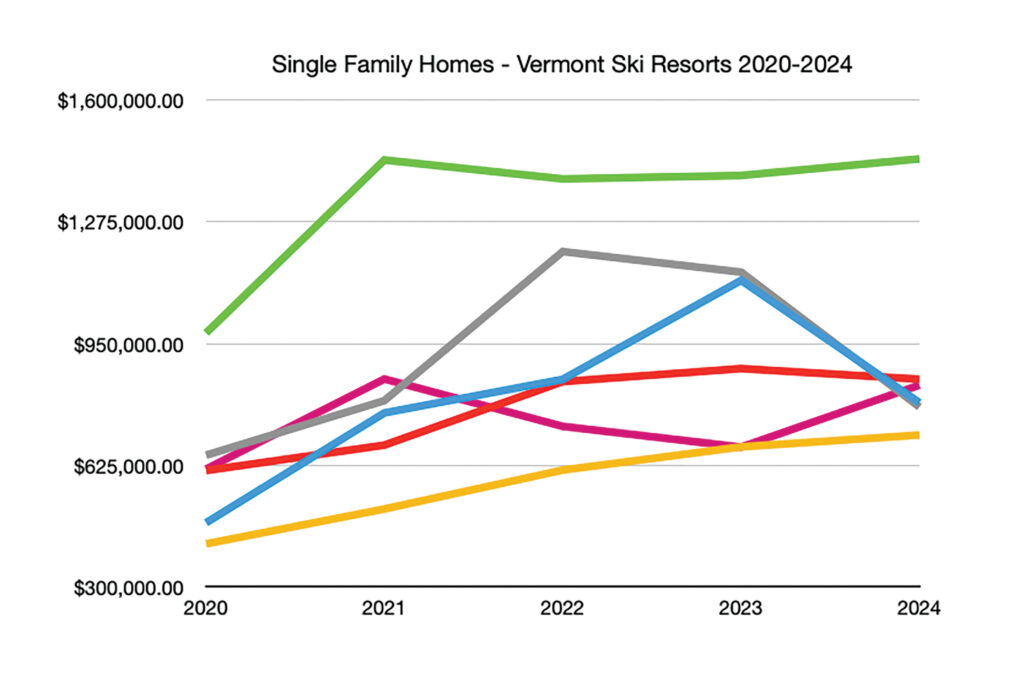

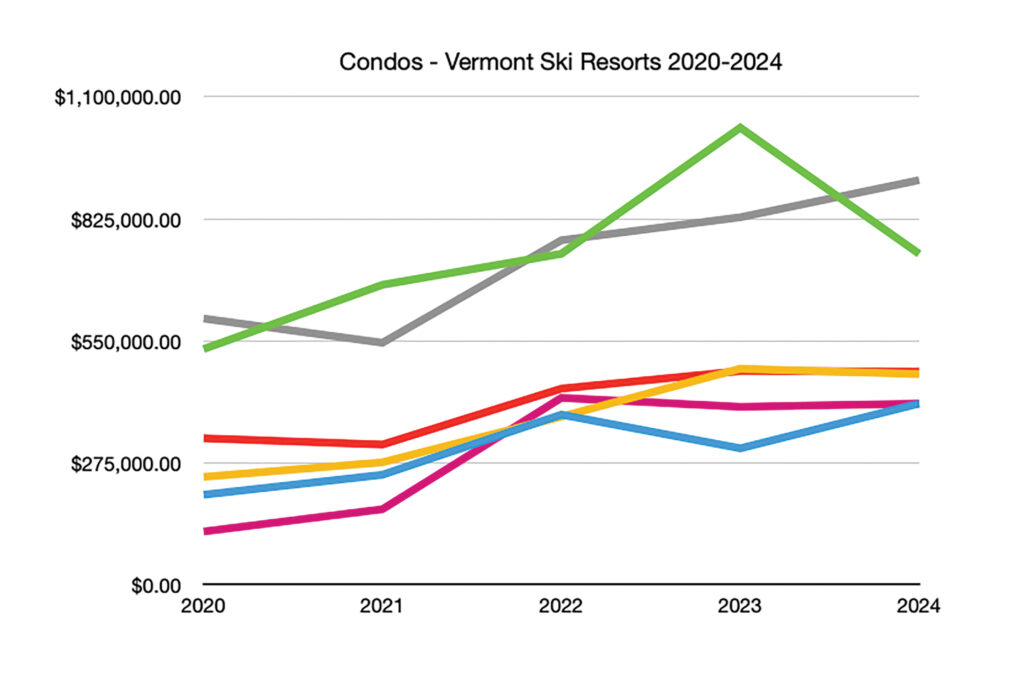

Courtesy Sotheby’s International Realty

Charts compare real estate prices at six Vermont ski resorts with the most desirable real estate. Top chart shows 2024 prices by size, bottom charts prices over time.

Homes in Killington continued to be in high demand, with prices continuing to climb as the local real estate market undergoes changes.

At the end of January, there were only nine single-family homes for sale in Killington, and just three of those were listed for under $1 million. Some of the homes for sale were atypical. The least expensive home on the market, for example, was an off-grid property on Little Sherburne Road, priced at $700,000, while the most expensive listing was a $3 million duplex on Roundabout Road that has yet to be built.

“It’s amazing the difference — what’s available and the prices,” said Nathan Mastroeni of the Elevations Real Estate Team at REAL Broker LLC.

While the pandemic saw homes being listed and sold rapidly, the market has now slowed, with homes sitting for an average of 60 to 90 days.

But “The market is healthier than it was during the pandemic,” Mastroeni added.

There is also a slight shift in people seeking investment properties. About 10% of buyers are looking to live in Killington, according to Mastroeni, while the remaining 90% are seeking second homes. Unlike the pandemic trend of investors buying short-term rental properties, many of today’s buyers intend to use these homes for personal use.

“They’re saying, ‘this is going to be a property that we are going to use’,” Mastroeni said. “It’s nice to see it’s not just the investors that are looking.”

Bret Williamson, owner and broker at Killington Valley Real Estate, echoed the sentiment that the market is stabilizing. “I think we’re going back to a more normal selling cycle,” he said, explaining that the winter market is slowing down after the pandemic boom. “Prices were escalating after the pandemic. Now, if homes are priced too high, they sit on the market. People still want homes in Killington, but they’re more educated, and the big rush is over for the time-being.”

Williamson had several high-end properties listed at the end of January, including the highest priced home for sale on Roundabout Road, offered at $2.9 million. The home is atypical in that it’s being sold as a development project. The plans call for a modern-style duplex home, with a one bedroom unit on one side and two-bedroom unit on the other. The high-end modern architectural design was created by Polar Life Haus in Finland. Once the home is sold, it will be shipped from Finland and constructed on site. “That’s fairly unique in this market. I’d think this would start happening more,” Williamson said.

The homes for sale in Killington also reflect much higher prices than what was available pre-pandemic. Last year, 26 single-family homes were sold in Killington, ranging in price from $340,000 to $2.81 million, with an average sales price of $791,000. In comparison, 34 homes were sold in 2019, with prices ranging from $258,000 to $2.4 million and the average home going for $542,000. But, prices aren’t increasing as rapidly as they were in the past four years.

“For now, price increases have stalled,” Wiliamson said.

Real estate agents are also bracing for the town’s scheduled reassessment this summer, which will be the first since 2011.

The townwide reappraisal is required because the town’s common level of appraisal (CLA) is the lowest in the state (at 52.35% before the statewide adjustment of 0.75 applied this January per Act 183), well below the state-allowed threshold. The CLA adjusts property values from their published values on each town’s Grant List to their actual market value by applying a blanket percentage difference to all properties. This ensures all Vermonters are paying taxes on their actual current market value.

The CLA in Killington being 52.35% means that property owners of a home listed for $250,000 on the Grand List are paying taxes based on its market value, which is nearly $500,000.

After the reappraisal, that Killington home will be listed on the Grand List closer to how it’s now taxed. When the reappraisal is completed the CLA should be 100%, in other words no adjustments will be needed as the Grand List will now match the market value.

While the CLA is a blunt tool applied to all properties equally, the reappraisal will take into account the specifics of each property to assess the value even more accurately — so some will see see greater increases in valuations than others.

The effect on tax bills will mirror whether the valuation for each property is more or less than the 52.35% that was already being applied with the CLA.

Heidi Bomengen, owner of Prestige Real Estate in Killington, expects more properties to hit the market after homeowners receive their reassessment notices, as many properties are selling for more than double their Grand List value. Bomengen pointed out one property listed in Killington for $875,000 was currently on the Grand List for only $240,000 — something that’s not uncommon — an example of just how outdated the town’s Grand List has become.

“I expect that we’re going to see more properties come on the market in the spring, or certainly in the summer after people have gotten notice of their new tax assessments, and particularly when the tax bills come out,” she said.

“People are going to get a shock. I think it’s going to put some additional price pressure on the market. It’s going to be the whole supply and demand equation. We’re going to see more supply, so buyers will have more to choose from, and there’s going to be more competition amongst the homes that are for sale.”

Williamson also said that the upcoming reassessment is long overdue, explaining that Killington’s assessed property values have long lagged behind actual market values.

“The taxes will most likely increase,” he said, but he didn’t think the new prices would be as shocking. “I don’t think they’re going to increase as much as in prior years.”

Real estate agents are also anticipating the construction of Killington Village, which will shake up inventory and home prices.

The Killington Village is a major multi-phase development project that will be constructed at the base of the mountain on 1,095 acres of land. Permits for Phase 1 call for 32,000 square feet of commercial space and 225 new units of housing with a mix of condos, townhomes, and single-family homes. Great Gulf’s re-envisioned village design includes a pedestrian-only Main Street that leads to the base of the mountain, where a crystalline lodge will replace the current Snowshed and Ramshead lodges.

Presales for new homes in the village could start as early as this fall. Williamson is also predicting that the demand for land will also increase. Williamson had two 3-acre parcels of land for sale on East Mountain Road for about $650,000 each at the end of January and anticipated listing more.

“Those would be the most expensive parcels of land to sell ever in Killington,” he said. “People are expecting the village to come in, and that’s going to be the most expensive real estate on a ski area on the East Coast. That’s highly justified because we have the best mountain in the East, hands down.”

Additionally, Base Camp at Bear Mountain broke ground this fall and expects vertical construction to begin on its 102 residential units in September with the first of the ski-in, ski-out duplexes occupied as early as spring 2026.