On Feb. 7, the Office of the Health Care Advocate (HCA) released a report demonstrating the affordability crisis that Vermonters face when purchasing health insurance and health care. In the report, “The Cost of Health Insurance: Quantifying the Vermont Affordability Crisis,” the HCA assesses the affordability of health insurance on Vermont Health Connect and shows that many Vermonters cannot afford health insurance.

The HCA’s report demonstrates that health insurance plans offered on Vermont Health Connect are unaffordable to a wide range of Vermonters. Together, the HCA’s three methodologies reveal the severity of the health care affordability crisis in Vermont.

Chief Health Care Advocate Mike Fisher said “as health care costs rise, many Vermonters must make the heart-breaking choice between paying for health care and paying for basic needs like food and housing. This is particularly relevant given the Governor’s budget proposal to increase out of pocket costs for low income families by cutting the Vermont cost Sharing Reduction.”

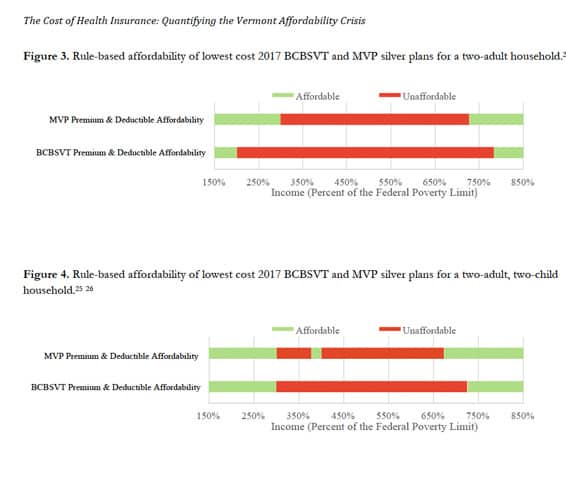

BCBSVT plans are unaffordable across a larger range of household incomes than MVP plans. However, regardless of insurance company, health insurance premiums and deductibles are unaffordable for many Vermont households. For example, for both companies, health insurance premiums and deductibles are unaffordable for couples with incomes between $48,060 (300% FPL) and $116,645 (727% FPL). The median Vermont household income is $56,104 (2016).

The HCA has helped Vermonters with health care issues, including affordability, since 1998. Every day, Vermonters tell the HCA stories of struggling to pay health insurance and health care costs. An advocate with the HCA described, “I recently spoke with a woman who had an unexpected health emergency. After she and her husband paid her ER bills and paid for his regular medication, the family couldn’t afford their premiums anymore. They lost their health insurance.”

This is not an uncommon scenario for Vermonters, many of whom cannot afford their premiums, out of pocket health care costs, or both.

In its paper, the HCA presents three different ways of examining and quantifying health insurance affordability in Vermont’s individual market. First, the HCA compares the cost of health insurance to Vermont wage and economic growth and demonstrates that health insurance costs have outpaced these macroeconomic indicators.

Second, the HCA uses a rule-based model that includes premium affordability standards codified in the Affordable Care Act and the deductible affordability standard used in the Vermont Household Health Insurance Survey.

Third, the HCA uses a market-based model that evaluates whether Vermont families can afford health insurance and health care and still be able to purchase basic necessities such as food, clothing, transportation, and housing. This model demonstrates that many Vermonters with a wide range of incomes are unable to pay for the basic necessities of life, including health insurance, without spending more than they earn. Many Vermonters have to make painful decisions about which necessities to forego.

“A Vermont family of four making $35,000 could find themselves more than $25,000 short after paying for their basic needs for the year,” Fisher stated. “Even Vermont families with moderate incomes may find themselves without enough money to cover their basic needs.”

The HCA’s concludes that the deficit increased recently because of the high cost of health insurance and other necessities, and the sharp drop-offs in federal and state assistance that occur at certain income levels.

The Office of the Health Care Advocate (HCA) helps Vermont consumers with a broad range of problems and questions related to health care services and health insurance. The HCA acts as a voice and advocate for consumers in health care policy matters before the Vermont Legislature and government agencies that oversee insurance and health care programs. The Office of the Health Care Advocate is a project of Vermont Legal Aid.