Education spending saw its biggest jump in years in fiscal 2025, and school taxpayers are noticing the change in their bills. The increase this year was due to a lot of factors outside both schools’ and taxpayers’ control—inflation, healthcare costs, and the loss of pandemic-era federal support chief among them. All of that led to an increase in total homestead taxes of 12.9%, although the rate varied from town to town, according to the Public Assets Institute.

But taxpayers can see their tax bills suddenly balloon even when spending increases are modest. The reason: thresholds built into the system. A majority of Vermont resident

Because the thresholds haven’t been increased or adjusted for inflation over time, more and more Vermonters have hit these cliffs and seen a jump in their school tax bills.

homeowners pay all or some of their school taxes based on their household income, which better reflects their ability to pay. But the Legislature has imposed limits on these income-based taxes, which means some homeowners—and the number has been increasing—pay a combination of the income-based and property-based school taxes.

The property taxes kick in when homeowners’ incomes or house values pass certain thresholds. These thresholds create tax “cliffs”— sudden rises in tax owed. Because the thresholds haven’t been increased or adjusted for inflation over time, more and more Vermonters have hit these cliffs and seen a jump in their school tax bills.

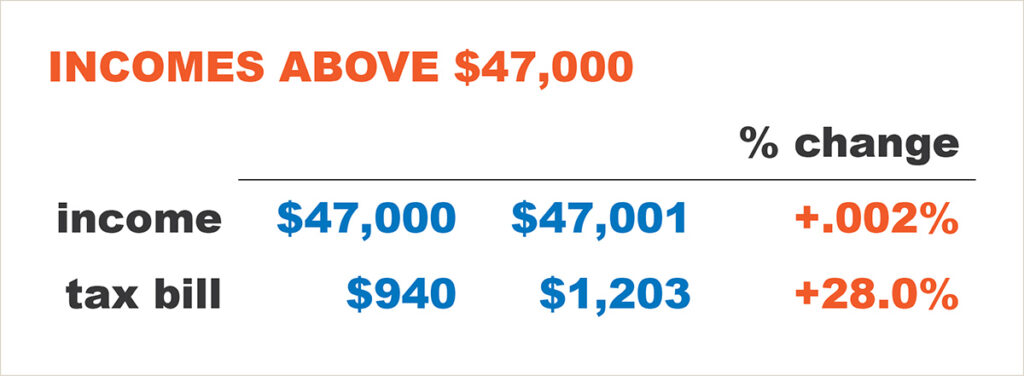

Cliff 1: The circuit breaker

This key threshold caps the share of income low-income Vermonters pay in school taxes. It was set even before Act 60 was enacted in 1997 at $47,000 in household income—and it hasn’t changed. At or below that amount, taxpayers’ school taxes cannot exceed 2% of their income. But above $47,000, taxpayers pay the town tax rate on income, which averaged 2.56% in fiscal 2025. So a taxpayer earning $47,000 would pay $940, but one earning $47,001 would pay $1,203.

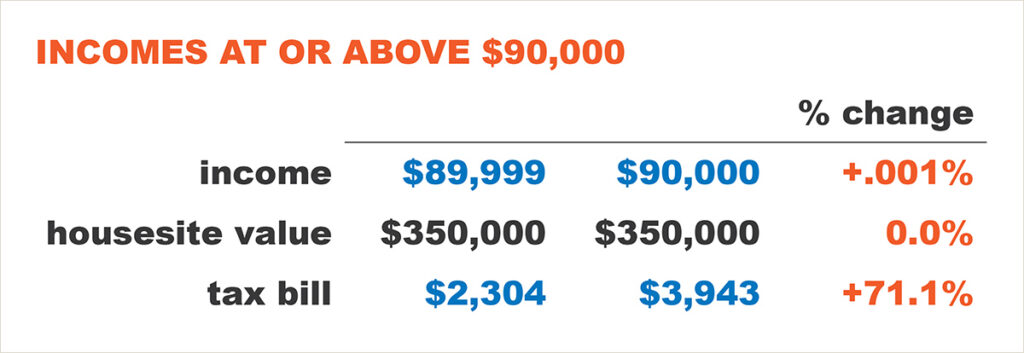

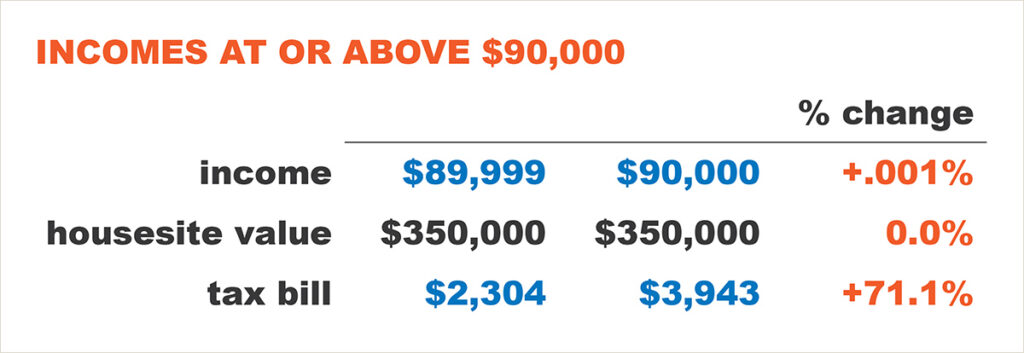

Cliff 2: Incomes at or above $90,000

Middle-class Vermonters run into cliffs, too. If they earn $90,000 or more, they pay a property-based school tax on housesite value in excess of $225,000 in addition to an income-based school tax. So a taxpayer with income of $89,999 and a housesite valued at $350,000 would pay $2,304 in school taxes at the average rate of 2.56%.

But if that same taxpayer, with the same $350,000 house, earned one more dollar in a given year, their bill would be $3,943—the income bill of $2,304 plus a property tax on $125,000 in home value, an additional $1,639 at the fiscal 2025 average property rate of $1.31.

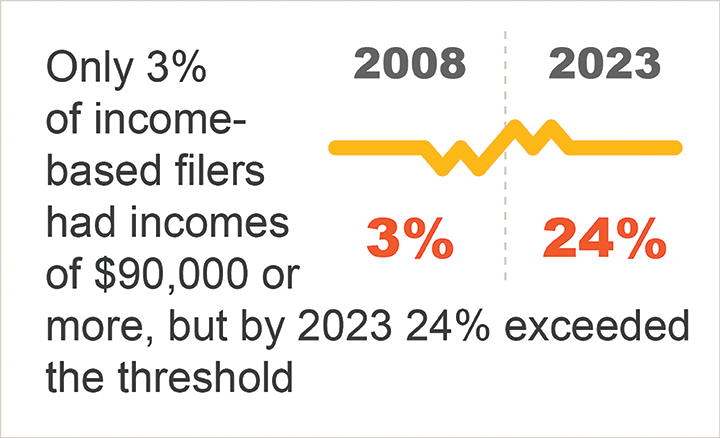

Given the growth in property values over the last few years, many more Vermonters are falling into these categories—24% of income-based school taxpayers were at or over the $90,000 mark in 2023, compared with just 3% when it was set in 2008.

Cliff 3: The cap on housesite value

Taxpayers with incomes below $90,000 also hit a cliff—they pay property taxes on housesite value in excess of $400,000. A taxpayer with $89,999 in household income and a $400,000 house would pay an income-based tax—$2,304 at this year’s average income rate. But for a $450,000 house, the same taxpayer would also owe property taxes on $50,000—$656 at the average property rate.

And the housesite value thresholds in all of these cliffs were lowered in 2018, meaning many more Vermonters began paying a school property tax, and those who were already paying that tax owed it on a bigger amount.

Effect of cliffs

These cliffs can have real effects on family budgets, contribute to the confusion and frustration with the funding system, and might discourage voters from supporting the needs of their schools. While the increase in overall spending in fiscal 2025 meant many more taxpayers faced spikes, these thresholds have been causing problems for an increasing share of Vermonters for years.

The examples above are intended to describe how the thresholds affect variously situated taxpayers at the average fiscal 2025 rates. It is not a comprehensive explanation of how Vermont school taxes are calculated. There are certain details that are not addressed here, such a cap on property tax credits, which can limit the tax reduction in property taxes, or the option to claim a small homestead exemption, which may be an advantage over an income-based tax for some low-income homeowners. These provisions affect relatively few Vermonters who qualify for property tax credits. Taxpayers in this category would also be subject to cliff 3 if their housesite value exceeds $400,000. A housesite includes the primary residence and up to two acres of land.

For more information, visit: publicassets.org.