By Peter D’Auria and Erin Petenko/VTDigger

Health insurance prices in Vermont are high — and getting higher.

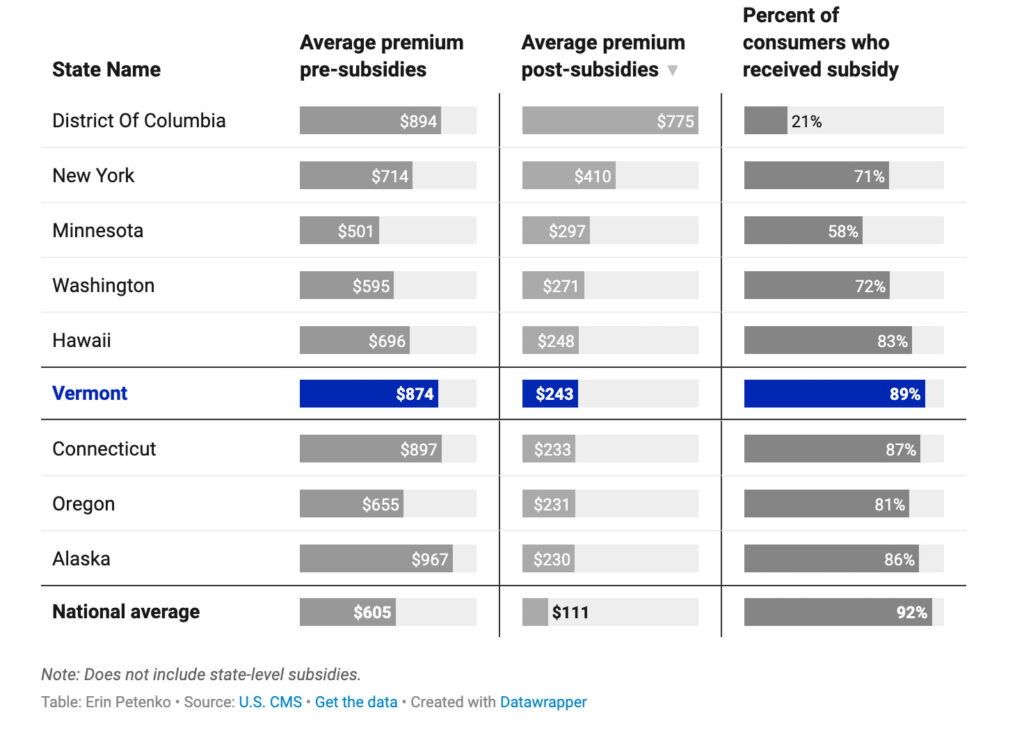

Average premium prices for individual marketplace plans in Vermont are among the highest in the country, according to data from the Centers for Medicare and Medicaid Services, costing more than double the national average, even when federal subsidies are accounted for.

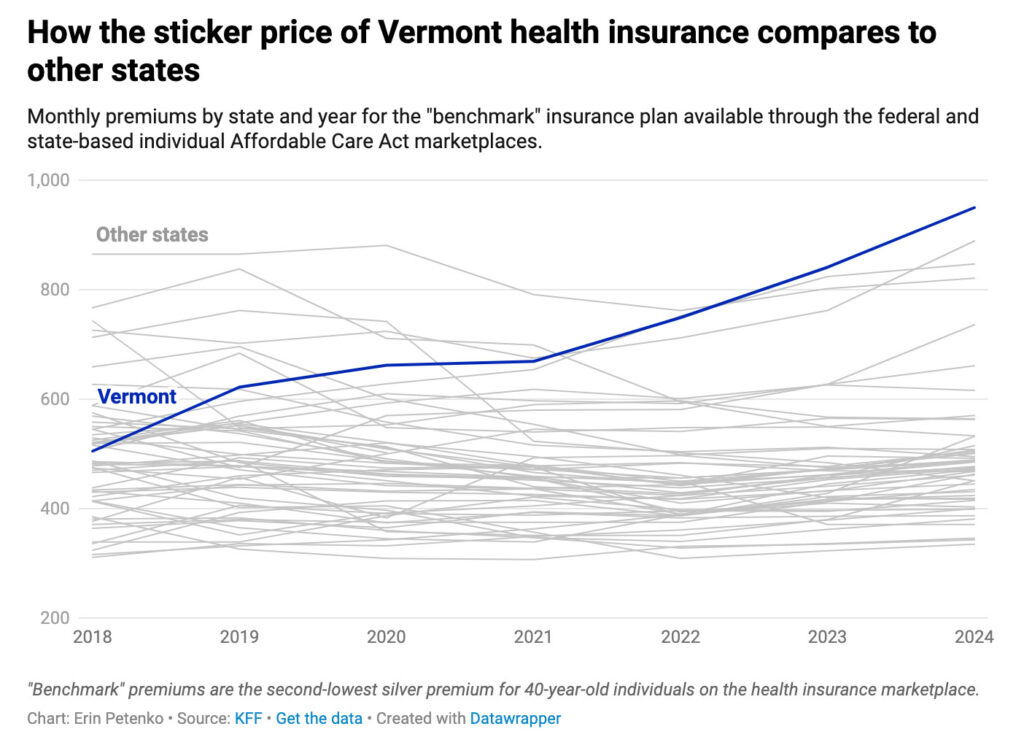

Vermont’s premium prices are rising by double-digit rates, significantly faster than in most other states, according to data from health policy nonprofit KFF.

“There’s no dispute. Vermont’s expensive,” said Mike Fisher, Vermont’s chief health care advocate. “We see it in our premium rates. We see it in our hospital commercial rates.”

Although the federal data only shows premium costs for individual plans, small and large group plans for employers have seen similar cost increases, according to Sara Teachout, a spokesperson for Blue Cross Blue Shield.

Courtesy Erin Petenko/VTDigger

How the sticker price of Vermont health insurance (monthly premiums for “benchmark” plans, i.e. the second-lowest silver premium for a 40-year old individual) compares with other states.

“The prices at hospitals, the prices for pharmaceuticals, all that stuff is the same across the marketplace,” she said.

Roughly 30,500 Vermonters are insured through individual marketplace plans, according to the Dept. of Vermont Health Access. Individual plans are plans bought by individual consumers, rather than employers, on the state’s marketplace, Vermont Health Connect. (They are referred to as individual plans even though they may cover a family.)

The average monthly premium for those plans — the sticker price — was $874 as of January 2024, among the highest in the country, according to federal data.

But because federal and state money helps offset those premium costs, most Vermonters who buy those plans do not pay that sticker price.

More than 89% of Vermonters on those plans received some form of federal subsidy to pay for them, according to the 2024 data from the federal Centers for Medicare & Medicaid Services. After those subsidies, the average premium dropped to $243 a month, and Vermonters who received those federal subsidies paid an average premium of $178 a month.

The state of Vermont also helps low-income residents pay for insurance with a benefit known as Vermont Premium Assistance. That benefit sets an upper limit on how much Vermonters can pay for premiums for an insurance plan bought on the marketplace, depending on their income.

According to the Dept. of Vermont Health Access, which administers the state marketplace, about 14,800 Vermonters on individual marketplace plans receive state premium assistance.

Data from the department, which is more recent than that from the Centers for Medicare and Medicaid Services, differs slightly from the federal figures. According to the Dept. of Vermont Health Access, the average amount of state premium assistance issued to Vermonters was about $35 a month.

That brings the average premium of Vermonters on individual marketplace plans down to about $210 monthly, according to the department. That is still a higher premium than those in roughly 40 states, according to federal data.

Certain policy choices also affect the sticker prices for insurance premiums, in ways that do not necessarily increase the actual cost of insurance.

In most of the country, health insurance premiums for marketplace plans are linked to a purchaser’s age. Older buyers, who are likely to be less healthy, pay more in premiums, while younger, likely healthier buyers pay less. Vermont makes no such distinction, meaning that younger purchasers pay relatively more money for plans, while older purchasers pay less.

For another thing, Vermont has employed a tactic called “silver loading”— a practice that hikes the sticker price for a key silver insurance plan. (Plans on the marketplace are classified as different metals — platinum, gold, silver, bronze — according to their premium and out-of-pocket costs.)

Because the federal government’s premium tax credits are based on the cost of those silver plans’ premiums, silver loading actually helps Vermonters save money. When the price of those premiums increases, Vermont is able to draw down more money in tax credits — making premiums cheaper.

Caveats, context and complications aside, Vermont insurance is still not cheap.

Even taking federal tax credits into account, the average premium for an individual marketplace plan in Vermont — $243 — is the sixth highest state average in the country, if Washington, D.C., is taken into account, according to federal data.

Unlike individuals, small businesses do not have access to public subsidies to help pay for their employees’ health insurance, according to Fisher, the chief health care advocate.

“It’s sort of stark,” Fisher said. “The small group is on its own out there. Small employers are on their own out there.”

Plans purchased through the small group market cover just over 37,000 people in the state, according to recent state filings by insurers.

Earlier this month, the Green Mountain Care Board, a key health care regulator, allowed MVP and Blue Cross Blue Shield, the two commercial insurers that sell on Vermont’s marketplace, to raise individual and small group insurance rates even further.

MVP’s premiums will increase by an average of 14.2% for individual plans and 11.1% for small group plans.

Blue Cross Blue Shield premiums will rise even more — by 19.8% for individual plans and 22.8% for small group plans.

Both insurers are raising rates far higher than the national average of 7%, according to data from KFF, a nonprofit health care think tank.

KFF compared 324 commercial insurers throughout the country that have reported preliminary rate increases. Vermont Blue Cross Blue Shield’s increase ranked eighth-largest in the nation, while MVP ranked 20th.

Blue Cross Blue Shield said those rate hikes were necessary to fill what the state’s Dept. of Financial Regulation described as a risky shortfall in the nonprofit insurer’s cash reserves.

“While we realize this is extremely difficult for our members, it is a necessary financial step,” Don George, the president and CEO of Vermont Blue Cross Blue Shield, said in a letter to community members last month. “Since May, health care claims have increased dramatically, and our member reserve levels have declined precipitously.”

Owen Foster, the chair of the Green Mountain Care Board, said those increases represented “deep fundamental failures in our healthcare system” in a press release earlier this month announcing the rate hikes.

“While these rates are plainly unacceptable, the alternative of an insolvent insurer unable to pay for patient care was worse,” Foster said.

What are the cost drivers?

At a basic level, health care spending is driven by the prices of care multiplied by the quantity of services used, according to Carrie Colla, a health economist at Dartmouth’s Geisel School of Medicine.

“As an economist, we think of it as P times Q, price times quantity,” she said.

In Vermont, both variables — price and quantity — have gone up over the past few years. In the past several months, Blue Cross Blue Shield, Vermont’s largest commercial insurer, which covers roughly a third of the state, has seen what some administrators have referred to as a “claim surge” — a spike in the number of claims filed by Vermonters who received care.

That surge has been particularly acute during the past three or four months, according to Teachout, the Blue Cross Blue Shield spokesperson. But claims have increased even over the past few years, she said.

Jordan Estey, MVP’s vice president of government affairs, said high costs for care and state policy decisions are largely responsible for Vermont’s high premium prices.

“Health insurance is expensive because the cost of health care services are expensive,” Estey said in an emailed statement. “We see much higher prices in Vermont compared to neighboring states for the exact same service(s) like MRIs and laboratory tests — which warrants further discussion about why that is, and whether these higher prices are fair and appropriate.”

Estey warned that Act 111, recent legislation that limits the cases in which insurers can reject claims from providers, is also likely to increase costs in the future — including an additional 6% increase by 2026.

“This estimated 6% increase will be on top of the ever-increasing costs of prescription drugs, hospital bills, and other medical services provided in Vermont—which is how we’ve found ourselves looking at premium increases of more than 10% on a consistent basis,” Estey wrote. “It’s simply not sustainable.”

Over the past few years, Vermont hospitals have requested repeated increases in prices for procedures.

Health care leaders say the reasons are numerous: The use of expensive specialty drugs, such as the diabetes and weight-loss drug Ozempic, are raising costs significantly, administrators say. A longstanding workforce shortage has led many hospitals and medical facilities to rely on traveling medical workers, who cost more than local staff. Vermont has a severe shortage of long-term care facilities and nursing homes, which results in hospitals providing care — often uncompensated — for patients who have nowhere else to go.

And as Vermont’s population ages, residents have presented with more complex and serious medical needs, requiring more frequent and more expensive care.

“We need more younger Vermonters who need less health care, are not on meds, don’t have chronic illnesses,” Stephen Leffler, the president and chief operating officer of the University of Vermont Medical Center, said this spring in a meeting with health care administrators and Vermont Sen. Bernie Sanders. “We’re seeing and feeling that every day.”

Even worse news could be on the horizon. During the Covid-19 pandemic, the federal government expanded eligibility for subsidies for premiums, allowing people with higher incomes to access federal money to pay for marketplace plans. But, without action from Congress, those expanded subsidies are due to expire at the end of 2025.

“Many of us who have been looking at this health care financing ‘not-system’ — the way we finance care — have been saying for a number of years that it’s unsustainable and that it can’t possibly continue,” Fisher said. “But it feels like we’re in a much more acute stage of that.”

Chart shows Vermont having the 6th highest cost of insurance for average premiums after federal subsidies.