Housing stock, affordability remain leading factors in impacting needs, study finds

The Department of Housing and Community Development (DHCD) announced Aug. 29 the publication of the Vermont 2025-2029 Statewide Housing Needs Assessment, a five-year document the U.S. Department of Housing and Urban Development (HUD) requires from government entities that receive federal funding. The findings in the report show Vermont’s statewide housing shortage remains and the affordability gap is growing as costs stretch Vermonters’ budgets thin.

“Vermont’s affordability crisis is directly tied to a lack of housing,” said Governor Phil Scott. “We cannot successfully grow our economy, address significant challenges in our healthcare and education systems, or improve quality of life for Vermonters without an adequate supply of housing across the entire state. My Administration is committed to improving and increasing our housing stock, which this Housing Needs Assessment shows is drastically needed.”

DHCD contracted with the Vermont Housing Financing Agency (VHFA) to complete the Vermont 2025-2029 Statewide Housing Needs Assessment.

Key Findings in the 2025-2029 report:

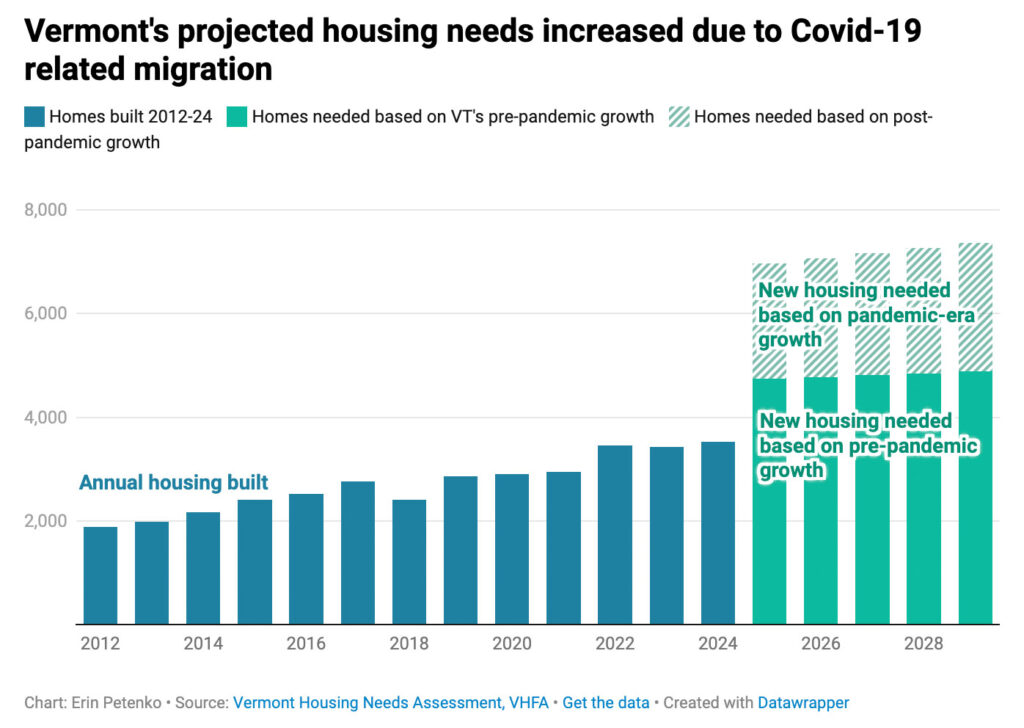

Vermont is likely to need an additional 24,000 to 36,000 homes by 2029.

Between 2019 and 2023, the purchase price for single-family homes increased 38%.

Between 2019 and 2023, the purchase price for mobile homes with land increased by 37%.

Half of all Vermont renters spend more than 30% of their income on housing.

One quarter of all Vermont renters spend more than 50% of their income on housing.

The portion of Vermont households that own their homes has remained fairly constant since 2010 at 70%-72%.

The Housing Needs Assessment, along with the mandated 2024 Fair Housing Analysis (expected to be published this fall by DHCD), informs the statewide Consolidated Plan that HUD approves for federal funding. The Housing Needs Assessment is also increasingly used by state and local officials to inform policy and spending decisions that address housing needs in our communities.

“Our housing policy should be about creating more opportunities for Vermonters to be able to find a place to live,” said DHCD Commissioner Alex Farrell. “Taxpayers dollars alone is not enough to build at least 24,000 units in the next five years, so we need to work with our public and private sector partners to accelerate unit generation in every corner of the state.”

The housing needs assessment shows the amount of housing needed in the state has increased since the pandemic influx.

Fixing Vermont’s housing crisis has been a priority for legislators and Gov. Phil Scott’s administration for years. In fact, the state spent $500 million of federal pandemic aid on housing initiatives, department Commissioner Alex Farrell said.

Some of the results of that funding should become clearer in the next year as more housing projects come online. But Farrell said that all that state spending is only half the story. Private investment, in his view, has to make up the rest of the gap.

Only 2,300 new homes were permitted in 2022, far below the 5,000 to 7,000 per year that the report estimates will be necessary to meet demand.

In recent years, the Legislature has passed bills to loosen local zoning restrictions and reform the state’s land use law, Act 250, for new housing. However, other hurdles for private development, like the rising cost of construction, is “largely out of our hands in Vermont,” Farrell said.

The pandemic changed the trajectory of Vermont’s housing market, according to department Commissioner Alex Farrell. Vermont’s population has grown since then due solely to migration, according to census data cited in the report.

“People are moving here,” he said. “We were begging them to for years and years, and then during the pandemic, they started moving here. … but we’re not ready for people to be here and to come. We don’t have homes for them, and it’s squeezing out the most vulnerable people.”

The Vermont Housing Finance Agency (VHFA) was established in 1974 to finance and promote affordable, safe and decent housing opportunities for low- and moderate-income Vermonters. Since its inception, VHFA has helped 31,000 primarily first-time home buyers and their families purchase homes. It also provides financing, development and management support, subsidy administration and tax credits for approximately 9,600 affordable apartments statewide.

Erin Petenko/VTDigger contributed to this reporting.