VEPC approval clears way for bond vote on Town Meeting Day

By Polly Mikula

The town’s Killington Forward plan is approaching actuality.

The plan — two years in the making — aims to provide clean water, road improvements, development of a mixed-use Six Peak Killington village, and to create workforce and affordable housing.

Over the past six months, the plan has cleared many major milestones required. Most notably: on June 30 Vermont Economic Progress Council (VEPC) approved the town of Killington to be a “Master TIF District,” on Oct. 28 the town of Killington signed a development agreement with Toronto-based Great Gulf, a residential and commercial real estate developer and, just last week on Dec. 15, VEPC unanimously approved the town of Killington’s phased filing for phase one of its Master TIF plan.

The final step is for the town to pass a bond vote on Town Meeting Day, March 7, for the first phase of development.

The cost of the first phase is projected to be $52,979,808 with about $50 million of that within the TIF district, according to the 2022 Phase Filing VEPC Staff Review. A portion of that cost will be offset by ARPA funds ($1,745,890 outside TIF and $554,110 inside TIF) and an emerging contaminants subsidy ($3,679,808). Additionally, the town expects to apply for further grant funding and forgivable loans to further defray the total. The town will be asking voters to authorize a not-to-exceed debt limit of $47 million ($26 million low interest loan and $21 million municipal bond).

The town of Killington stated in its application: “As additional funds are secured, the town will not need to draw down as much debt and will likely not incur the full $47 million by the time Phase 1 is complete.”

Stephanie Clarke, vice president of White + Burke Real Estate Advisors, who the town hired to oversee its TIF application, told the council at the Dec. 15 VEPC hearing that the financial assumptions and projections were very conservative, and the true cost would likely to come in under budget. “This is a very conservative projection. We’re going to be continually trying to reduce that amount of debt, and we’re actively currently doing that,” she said.

Municipal investment for the full TIF district plan (all phases) are estimated to cost $62.3 million, so this first phase represents 80% of that total buildout.

As a result of these improvements and the first phase of the private sector development of Six Peaks Village at the base of Killington Resort, the town estimates the grand list will increase by $295.85 million which, in turn, will generate $98.5 million in incremental property tax revenues over the life of the district ($17.2 million municipal and $81.3 million education).

Phase 1

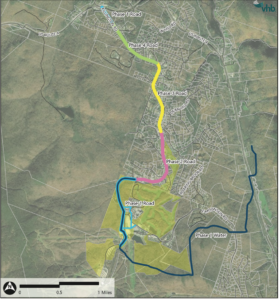

Map of Killington Forward’s phasing stages. The blue lines indicate the first phase, which was recenly approved by VEPC and will get underway after a positive bond vote. Light blue is the first phase of road and dark blue the first phase of water.

The vast majority of the Phase 1 infrastructure development will be paid for via TIF. It will include:

- Water System: Bringing water from Route 4, up the mountain into and through the village, and down Killington Road to the end of SP Land Company and Killington Resort property.

- Killington Road (Section 1A): Reconstructing Killington Road from the SP Land Company and Killington Resort property lines (the northernmost edge of the TIF district) up to and including a new roundabout at the intersection of East Mountain Road, constructing Road H and reconstructing Old Mill Rd and East Mountain Road, and taking ownership of these roads thereby creating a connected municipal road. (Section 1B): Reconstructing the section of Killington Road from Route 4 to Anthony Way.

Phase 1 will also include bringing the water down to Ravine Road and putting in dry lines from Route 4 to Anthony way, but that portion is outside the TIF district and will be funded by alternative means.

Future phases will include reconstructing the middle portions of Killington Road (financed through TIF) and bringing the water system down Killington Road and onto a portion of Route 4 to the west (financed outside of TIF).

Approval process, retention timeline

Prior to approving Killington’s phased filing, VEPC staff reviewed submitted materials and consulted with Jeff Carr of Economic & Policy Resources (EPR), and ACCD General Counsel John Kessler, both of whom wrote reports advising the council to approve the filing.

The retention period for the TIF district is anticipated to begin in year 2024 and end in year 2043. For the first two years the town is not anticipated to accrue increment, as there is a two year span between construction of the water system and construction of the private development. Increment will begin accruing in 2026, once Six Peaks development is expected to be underway.

Therefore, the TIF district is expected to incur an annual deficit for three fiscal years beginning in 2024 and running through fiscal year 2026 to a maximum of $1.9 million.

“The updated First Phase Filing TIF District Financial Plan now also expects that the town will return to an annual surplus position by fiscal year 2027 in terms of servicing the debt and covering its costs associated with the Phase I infrastructure development plans—with the cumulative revenue surplus beginning in fiscal year 2028 and running each fiscal year through fiscal year 2043,” wrote Jeff Carr in his EPR review. “By then, the TIF District Financial Plan expects the TIF District would have accumulated a sufficient operating surplus to retire all of the anticipated general obligation debt service payments through fiscal year 2055 (although there will be annual deficits in the out-years of the financing plan to completely pay off the debt) with an anticipated $4.036 million cumulative surplus after the debt is expected to be fully retired.”

At the VEPC hearing Dec. 15 Town Manager Chet Hagenbarth told the council that the town is “comfortable with the $1.9 million cumulative deficit in the first couple of years.. and that the town is able to manage that deficit with the town’s pooled cash.”

Carr noted that the financial assumptions and projections were conservative in his EPR review, stating: “The proposed TIF District Minimum Assessment … of the private development agreement are appropriately conservative. This is especially true, given the use of only roughly two-thirds (or 68%) of the full buildout valuations have been employed to cover debt service in the First Phase TIF financial plan … the development agreement also provides additional assurances that there will likely be sufficient resources generated by the private development activity to support the updated TIF financial plan’s key assumptions and projections. As the applicant also correctly notes ‘…In the event that Great Gulf develops even less by such time that the town is required to pay debt service, the Development Agreement binds the developer to pay the minimum value.’” EPR concluded that the development agreement provides assurance that there will be sufficient resources to pay the debt service.

What’s next?

The Killington Select Board is expected to officially put the TIF bond on the ballot at its regularly scheduled meeting Jan. 30. The town will then host a public information session on Feb. 13 specifically to address any questions or concerns voters may have regarding the TIF bond. Questions can also be answered at the March 6 regular town informational meeting before the vote the next day.

Concurrently during this time, the town is preparing bid documents for the construction of the two projects: water and road (separate bids), and applying for the necessary loans and permits, Clarke explained.

“All of that kind of happens concurrently pending approval by your voters in March,” she said. “Once Great Gulf takes control of the (SP Land) property after the vote, they’ll transfer the easements and assets we need to break ground in late spring, most likely June 2023. And it’s a two year construction cycle through 2024,” she explained.

While planning continues, the focus will largely be on the bond vote, because without voter approval all plans for Killington Forward will be on hold until approval can be secured.

“I’m confident the bond will pass,” said Selectman Jim Haff. When asked what the plan was if it didn’t he simply responded, “We’ll have another vote.” Adding, “I don’t think it will come to that because most residents understand the benefit this will bring our town for many years to come — and the development agreement that eliminates risk to the taxpayer, as the tax increment will fund the debt.”