Real estate market slows due to lack of inventory

By Katy Savage

After a frenzy of home buying throughout the pandemic, the housing inventory in Killington (and surrounding communities and across the U.S.) is the lowest local real estate agents have seen, which has brought a halt to the frenzy of real estate activity.

There were three family homes on the market in the Killington area on Nov. 16.

“I don’t think I’ve ever seen that few,” said Bret Williamson, the owner of Killington Valley Real Estate. “Generally homes that are priced well are gone pretty quick,” he said. “The condo scene is pretty much the same. There’s really not a lot of inventory up here. It doesn’t surprise me. Killington has a ton going for it.”

Heidi Bomengen, the owner of Prestige Real Estate, said there would usually be 100 properties on the market at this time.

“If you could find 10, that would be a lot,” she said. “There’s like nothing out there. But there’s a lot of new owners,” Bomengen said. “There’s a lot of people that are looking to enjoy them.”

Kyle Kershner, the owner of Killington Pico Realty, said the market is “probably approaching historical lows.”

“That’s not unique to Killington,” he said. “This is across the country.”

A total of 57% of real estate agents in the United States cited a lack of inventory as the leading reason limiting potential clients from buying a property, according to the National Association of Realtors’ 2022 annual report.

Kershner said the soaring interest rates have discouraged owners from selling.

“They’d be crazy to sell and trade their 2 1/5% mortgage rate for a 7% mortgage,” Kershner said. “Unless they have a requirement to sell, they aren’t going to. They’re going to wait this out. It’s really a waiting game.”

While there are still interested buyers, real estate agents said homes are sitting longer on the market and getting fewer offers than they got last year. As always, buyers are primarily coming from New Jersey, New York, Boston, and Connecticut. Many are looking for vacation homes or investment properties as opposed to primary residences.

More buyers are asking,“‘Can I rent it?’ Instead of, ‘How are the schools?’” said Nathan Mastroeni, the broker at Four Seasons Sotheby’s International Realty in Killington.

Fewer offers

The days of buyers purchasing homes sight unseen and forgoing inspections seem to be over, area agents said.

Kershner said the level of real estate activity has seen a “major shift” this past year.

“The mortgage applications are down at record lows,” he said, citing national statistics that show demand for mortgages at the lowest level since 1997. In late October, mortgage applications were down 42% from the same week in 2021.

“I’m not going to say there are no buyers,” Kershner said. “I’m still listing properties and still getting multiple offers, but it’s a different pace now.”

Last year, Kershner remembers showing a property 17 times on the first day and getting 18 offers on the second day. Now, he may see 3-5 offers on each property.

“There’s not multiple showings on the first day,” he said. “We’re not seeing those bidding wars.

Six to 12 months ago if you were financing you were pretty much out of the game. You were going to be up against a cash buyer.”

But, for the right property, “There’s still a lot of competition,” Kershner said.

Kershner listed his own 11-acre piece of land in Stockbridge for $119,000 in early November.

He had multiple offers and expected it to sell 10-15% above asking price, he said.

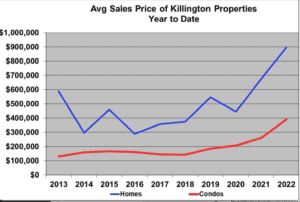

Home prices are still higher than they were last year, but the increases are starting to plateau.

“It’s not as much of a free for all as it was during Covid,” said Kaitlin Hummel, an agent at Prestige. “People are thinking, ‘OK, am I overpaying? Is it worth it to me?’”

Mastroeni said about one in five of his properties have multiple offers. The longer a property sits, the lower the price drops.

“It’s taken a little longer to sell and prices have leveled off,” Mastroeni said. “The price acceleration has really calmed down, which is good in many senses. If you’re priced correctly, you can still be in a situation where you see multiple offers. If you’re priced too high, you may be sitting.”

Bomengen said last year, homes were selling within the first week. Now homes are sitting on the market for at least two to four weeks. Most buyers are looking for vacation homes priced around $300,000.

“Anything under $600,000 is going fairly quickly,” she said. “Once you get over $600,000 it’s got to be in really great condition or have four or more bedrooms.”

Buyers, perhaps surprisingly, tend to be people or entities looking for investment properties, despite high-priced real estate and soaring interest rates.

“The thing I’m still a little surprised about is how many investor buyers there are — people who are looking to buy and rent,” Bomengen said. “I thought that would have slowed down based on the way prices have gone. You have to do a lot of rentals.”

But, she said the rental demand is strong, echoing Williamson’s statements.

“I’ve been doing sales as well as rentals for 20 years,” Williamson said. “With the event of Airbnb and VRBO, the short-term rental market is very popular so it’s taken away from the inventory of long term winter seasonal for November- May. Now that is not as much of an option.”

The 30-year fixed-rate mortgage averaged 6.61% in the week ending Nov. 17, down from 7.08% the week before, according to Freddie Mac — the largest weekly drop since 1981. Though down, it’s still more than double the rates of a year ago, when the 30-year fixed rate was 3.10%. Experts predict interest rates may rise back above 7% again before the end of the year as the Fed commits to increasing the funds rate to reduce inflation.

Meanwhile, the National Association of Realtors is forecasting overall transactions in the United States to be two million transactions fewer than they were last year in 2021.

Williamson said Killington is 6-8 months behind the national news.

If inventory improves, there’s still demand. Most Killington homebuyers are prepared to pay with cash.

“Interest rates and things of that nature don’t seem to affect this market as much as a primary home market would,” Williamson said. “There’s still a ton of interest.”

Despite the lack of inventory, “It’s still a relatively healthy market opposed to what the national news will tell you,” Mastroeni said. “In the national news, the world is ending, the real estate market is ending with it and nobody will ever sell a house again.”

Kershner said there’s an affordability crisis across the nation.

“Prices are at record highs,” he said. “They are about 28% higher than they were last year,” Kershner said.

Still, Kersnher said “there’s nothing to be an alarmist to be about this winter.”

As interest rates rise, sellers may be enticed to lower their asking prices.

“Experts are anticipating a 5-10% correction in housing prices,” Kershner said. “I think we’re in this for a while. The Fed’s not done raising interest rates.”

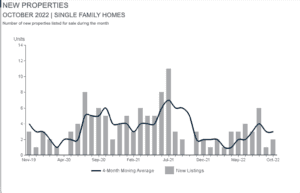

Killington’s slowest sales period is generally May and June and November though January. Bomengen said the inventory would likely not improve this winter.

“People will start to list properties in the spring again,” she said. “What we’ll see then will be completely dependent on the economy.”

Williamson was hopeful for the future of real estate in Killington. He said planned housing developments and investments in the area will keep the market healthy.

“It’s really exciting,” he said. “I feel we’re the best resort in the East by far. We offer the most in terms of skiing, terrain and four-season activities. To see neighboring resorts command significantly higher prices for their real estate, it doesn’t surprise me that Killington has been on the rise for the past couple years and the future looks bright.”

Until then, Kershner welcomed the break.

“After going 100 miles per hour seven days a week, there’s more me time right now,” he said. “I’ll take that. From a business perspective, it was phenomenal but very taxing emotionally and on your time and your family time and personal time. That all had to be set aside. It’s nice to get some of your life back.”