High prices are here to stay, market was undervalued, experts say

By Polly Mikula

The average home in Killington sold for over $1 million in the first quarter of 2022 — the highest evaluation ever — and those prices are indicative of the town’s, region’s and state’s growing value, say local real estate agents who have each worked decades in the industry.

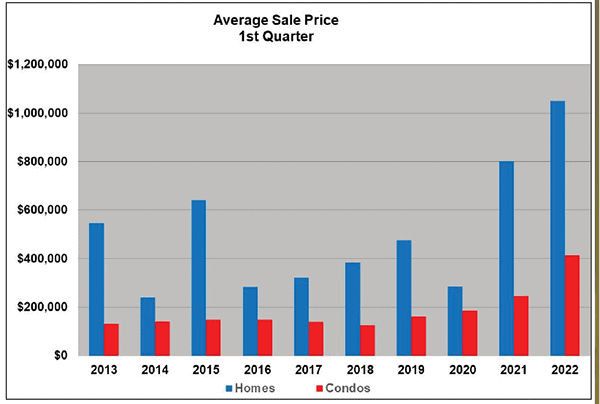

“The average sale prices of homes and condos have increased dramatically,” wrote Heidi Bomengen, owner of Prestige Real Estate, in the company’s quarterly newsletter published April 1. The average sale price of condos in Killington was up 67% to $413,000 in the first quarter of 2022; the average home prices up over 30% to over $1 million, according to Bomengen.

Nathan R. Mastroeni, Sotheby’s regional manager of offices in Rutland, Stowe, Middlebury and Burlington, which collectively has about 50 real estate agents, concurred, saying: “The biggest thing that we’ve seen versus the past is the upper prices,” he said in an interview March 28. “I was speaking with the Southern Vermont Regional Manager [Ellen Mallia out of the Stratton office] earlier today and she said ‘Honestly, it’s starting to feel like $3 million is the new $1 million,’ which is really true and not just in there. The growth of property values is statewide,” he added.

Recently, a three-bedroom house at 167 Foster Farm Road in Killington (about 2 miles from the slopes), was priced at $2.8 million and went under contract in 14 days. Freddie Ann Bohlig was the listing agent.

“It’s not closed yet,” Mastroneni said. “But a $2+ million dollar house pre-Covid would take potentially years to sell. It wouldn’t be a conversation. Nobody would have thought that possible, they’d say we were insane to list it. And it went in two weeks. That’s just one that really stands out to me. It’s an absolutely gorgeous house. Still, it takes a particular buyer, being north of $2 million.”

Bret Williamson, agent at Killington Valley Real Estate, has also seen many $1+ million sales, adding that 75% of his recent sales in Killington have been cash offers — at all price points.

“They need to put out a cash offer to be competitive,” he said. “Being a second home market, having a cash sale wasn’t unheard of. But now it’s almost expected. I sold the VISTAs over at Bear Mountain for cash at $1,795,000,” he said of a four-bedroom ski-on, ski-off property with views of Bear Mountain at 92 Vistas Drive. It sold in February.

Williamson said, however, some buyers now refinance after their cash offer is accepted.

Mastroneni said, regionally, the number of cash offers “really just depends on price point and location … generally there are more cash offers in resort markets.”

Chart shows the average sale price for condos and houses in Killington for the first quarter of 2022. Six houses were sold in the first three months of the year, garnering a record-breaking average of over $1 million.

Prices continue to rise

When compared to other resort towns, prices in Killington have increased more dramatically, but part of the reason is that they started lower, agents explain.

Bomengen illustrated this point by example: “I had a guy that moved up a year ago from Ludlow and he thought he got a great deal in Killington when he bought a townhouse in Sunrise for $340,000. He said: ‘If I bought this at Okemo it’d be over $500,000.’ We sold it for $675,000 a year later.” That was $76,000 over asking price, she noted of the two bedroom condo sale.

Another condo sold recently for $774,000 (with an additional $50,000 paid for furnishings) at King’s Pine in Killington — a total of $125,000 over asking price.

Prices are pushed higher when demand exceeds supply.

“The basic economics always tells us if we have a bunch of people that want something we don’t have a lot of then that price is probably going to rise,” explained Mastroeni.

“It’s a classic supply and demand situation,” said Kaitlin Hummel, an agent with Prestige Real Estate.

“And there certainly has been an increase in demand,” Mastroeni added. “I think the last two years are just kind of off the charts, in every aspect.”

That’s true for residential as well as resort real estate, he noted.

But it’s not accurate to say there’s no inventory in most markets, Mastroeni contended, “because you hear a lot of people say, ‘oh, there’s no inventory, there’s nothing to buy’,” he said. “There have been plenty of things that have been coming up. It’s just that they’re going under contract really quickly. And so it’s what we’ve been calling it is either a ‘high velocity market,’ or we have a term where we say we have a ‘standing inventory problem.’”

The trend of properties being swept up quickly has become more extreme over time, while inventory levels in Killington are actually almost the same as they were in the first quarter of 2021 — both of which are near all-time lows — with six homes, 31 condos (26 of which are at Mountain Greens), and eight parcels of land (excluding two pre-construction projects). Additionally, six homes, eight condos and 10 parcels of land were currently under agreement as of April 1.

This year, however, the days a property remains on the market is less than half of last year, noted Bomengen.

During the first quarter of 2022, “demand far exceeded supply as evidenced by the drop in days on market and many situations of bidding wars,” Bomengen wrote in her newsletter.

(Mountain Green Condominiums are undergoing a structural assessment that is projected to cost owners $4 million, $18 million or $26.5 million to address, depending on what the association chooses to address, which understandably has put a bit of an asterisk next to those properties, at least until actual cost can be determined.)

Demand exceeding supply and causing properties to sell fast is widespread throughout the region and state.

Williamson who recently bought a house in Rutland Town, said: “I’m seeing the same thing there and I’m hearing it from other agents in other towns that it’s the same scenario. It’s very thin inventory and competitive… In other ski towns, like Okemo and Stowe and Stratton, it’s definitely the same,” he said.

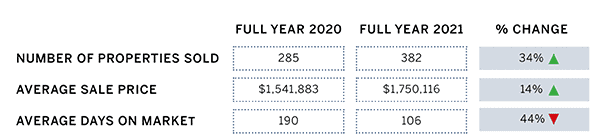

Chart shows 34% increase of $1+ million homes in Vermont at the end of last year compared to 2020. Additionally, the average price for those homes increased 14%, while the days on the market decreased 44%.

What do buyers want?

When asked what buyers are looking for in a Vermont home, real estate agents said that question was somewhat irrelevant these days; rather, buyers have to conform their interests to what’s available and then jump— fast and preferably with a cash offer — if they want to get in on a property at all.

But agents still listen to wishlists, while setting realistic expectations.

“I would say people generally asked for updated properties,” Williamson said. “Things that are a little more updated than ‘80s or ‘90s carpeting and old appliances and things of that nature…I would say just something that they can kind of move into and not have to do a ton of work … And just shut the door behind them and go home if they are in a hurry.”

Mastroeni agreed. “I would lean towards the less work. They’re not really modern because we don’t have that — the, like, ultra modern New York feel with like steel and glass — obviously, we don’t have a lot of houses like that. But most people are looking for something that’s ready to move into … most people are not looking for a lot of projects when they move in.”

Sellers: price reasonably, you’ll get top dollar

When asked why sellers wouldn’t simply list their properties higher in the first place, Bomengen explained that the opposite outcome results.

“Sellers often push to do that,” she said. But the problem is that if a property hasn’t sold quickly in this climate buyers figure something is wrong with it because it hasn’t moved, she added.

“I mean, just from a practical sense, two weeks is too long,” said Bomengen of the number of days a property should last on the market. “That is different than last year!”

Data from the first quarter of this year shows that properties in Killington that were priced to sell typically garnered offers well over asking price — often significantly — whereas properties initially listed too high, either eventually got their price or lower.

Homes on the market more than two weeks sold at 15% to 20% under their asking price, according to Bomengen.

“Yeah, I know that actually goes against what most people think,” she said, adding that it’s hard to convince many sellers of this fact, too. “How do you tell somebody, ‘Don’t price it too high because if you do you’re not going to get it, but if you price it a little lower you might actually get more than that number’ … but that’s what’s actually happening,” she said.

“In years past, we had things on the market for 200 days, now we have things on the market for two days so you’re dealing with a multiple offer situation on anything that’s decent,” she added. “If you don’t have a frenzy, then you have to kind of take a step back and say, ‘Did we over price it? or What’s wrong?’”

Who’s buying?

When asked who is driving all the demand, where are new buyers coming from? Real estate agents said the geographical draw hasn’t changed; there’s just more people coming.

“We have still been seeing a very high draw from Boston, New York, northern New Jersey and Connecticut. Those are the main feeder markets for us, basically along the seaboard from Boston down to middle New Jersey has always been consistent,” Mastroeni said. “For most, it depends on the driving time. Most people want to stay within four or five hours of their home.”

While some folks are looking for a life change, and interested in a primary residence, said Williamson, most are still looking for a second home (particularly in Killington). In fact, that category has expanded as short-term rentals make the option more affordable to more people, Williamson explained.

“The advent of Airbnb and VRBO has really, I would say, opened the doors to a broader range of people that could own a second home because that model helps them cover carrying costs,” he said.

Bomengen, who sells exclusively in Killington, said she’s had very few primary residence buyers interested over the past 20 years, “I think you could count on one hand how many primary residences I’ve sold,” she said.

Bomengen, however, has noticed a pretty consistent cycle over the years with second home owners.

“There’s kind of a 10-year cycle,” she’s observed. “It’s always been that way with the exception of the investors. People who buy generally stay about 10 plus-or-minus years and it’s based on where their kids are at,” she said. “They’ll buy when the kids are 6 or 7-ish and they want to put them on skis. Then when they get into their junior year in high school and they get into either basketball or hockey they leave because they’re not using the place. Or they’ll try and rent it for a year to figure out where the kids are going to go to school … if they’re not going to come back very often they’ll sell it because they don’t want to rent any more. That’s the most frequent scenario: they sell in 10 years and then the next family with a 6-year-old comes and they do the same thing,” she said. “Another common scenario is that the kids get really into the ski club, say, and then they buy a bigger place because the grandparents now wanna come up and their friends.”

Then there are the folks who buy for the investment value. These buyer are looking for properties that will make them money (the vast majority through short-term rentals). Unlike second homeowners, they have no intention of using the properties personally. Most own multiple rental properties.

“Investors are a big part of the market,” Williamson said. “Most are individuals or partners … They do the research themselves, I give my input and then they run the numbers and make the call. They know what they can rent it for and what their ROI [return on investment] is going to be.”

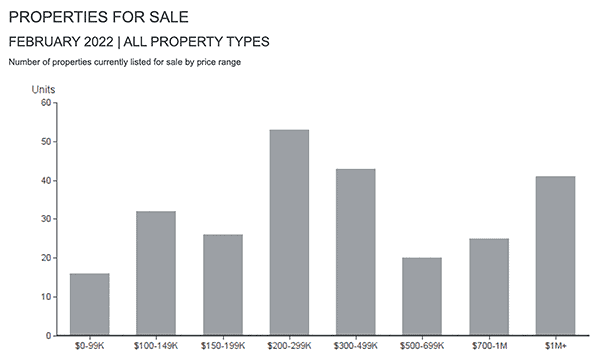

Charts show current inventory in Killington for homes, condos and land by price point — ranging from 1-15.

Charts show current inventory across Rutland County for homes, condos and land by price point.

New spring inventory?

“We generally see more inventory in the spring, especially around the resorts,” said Mastroeni. “A lot of people that are doing short term rentals right now. They’re booked and it’s really hard to sell something when you have a ton of rentals. Come a month or two from now when the rentals will start to slow down, that’s when a lot of people will say, ‘Alright, it’s time to put the house on the market.’”

Williamson also expects to see more inventory coming up soon. “There’ll be more coming on the market in the spring. I’ve got seven listings I’m working on right now,” he said during an interview March 28. “I’m working on a lot of the seasonal rentals where the owners are there ready to be done. Once May hits and those rentals end, they’ll be tenant free, they’ll be cleaned and ready to go.”

Williamson noted that many rental property owners are ready to cash out. “They’re done and they can sell their property for a lot right now. It’s just a lot of work to have a short term rental and for the long-term, seasonal rentals, even though they’re relatively easy (they get traded on lightly, everything’s paid up front and it’s really no risk) they’re like: ‘You know, I might as well do it now when the markets high.’”

Bomengen, however, encourages folks to wait a bit and not list their properties immediately in the spring. “May usually is pretty dead here. Look at the sales activity over the years, nobody’s here that’s buying property in May. The only people who are still here are the hard-core tailgaters and they’re not buying real estate.”

If a property is listed too early, then it will look like it’s been on the market a long time by June or July when interest usually starts to pick back up, she said, and that can cause potential buyers to wonder if anything is wrong, if there’s a reason it hasn’t sold.

“Wait until people actually start coming out for the summer,” she advises. “It usually stops around Easter and it doesn’t start again really until around the Fourth of July.”

Obstacles?

Recent interest rate increases, coupled with the promise of more increases coming down the ‘pike, typically has a depressing effect on real estate. But, so far, that hasn’t been an obstacle locally, and agents don’t think it will be.

“We’ve seen a rise in interest rates already. But we’re not seeing much of an impact in the market in general,” Mastroeni said. “Potentially, if interest rates were to rise to 6% or 7% we could certainly see a decrease in the amount of buyers… But with cash purchases being as high as they are right now, many aren’t affected… There may be a moment in time where we start seeing a shift, but just from the 2.8% to the 4.5% that we’re seeing now, we haven’t seen much of a change,” he said of local markets throughout the state, both residential and resort-based. “I think interest rates are heading north but I don’t see them going much, much higher,” he said, adding: “Inflation could be a potential headwind, but really for our market right now… it hasn’t seemed to impact the marketplace too much.”

Another obstacle many feared would damper demand was a call back to city offices after Covid subsided. But if it’s happening, it doesn’t seem to be impacting demand locally.

“At the beginning of Covid, we were going from five days a week in the office to two or three and that was a really crazy idea. Two years later, a lot of people are zero days in the office, and two or three days in the office sounds like a really crazy idea,” Mastroeni said. “I think we’re on the other end of things, and now the employees have this amazing thing: They can say, ‘Look, it’s been two years, we’re working fine, the businesses running, do we really have to come back in?’ … I think there’s going to be a pretty extended period of time until the companies can say: ‘We need you in here five days a week, you can’t work on your laptop at your house in Vermont.’ I just don’t see that changing soon.”

Future predictions

The region’s high prices, high demand and low inventory will continue, barring any unforeseeable dramatic change (i.e. Covid two years ago), Bomengen, Mastroeni and Williamson all predict. And it’s not a bubble, they say -— higher prices and values are here to stay. In fact, they haven’t peaked yet,

according to most agents and the economists they cite.

Real estate values in Killington, particularly, have been undervalued for years, Williamson said. “Now we’re, in my opinion, leaps and bounds ahead of any other resort in the East… When you compare us to some of the other resorts close by, they’ve been commanding these prices and higher prices much longer.”

Mastroeni agreed, citing Stowe as an example. “If we look at Stowe, for example, my office has an average sale price right now of $2 million… So there’s there’s definitely a discrepancy there.”

“I think we’re catching up,” said Bomengen of Killington values. “We believe the rapid, exponential increase will dissipate but we do not believe there will be a sudden drop in value. It’s taken the Killington market a long time to catch up with other Vermont resort markets.”

The recent investments at Killington Resort (tunnels, new chairlifts, snowmaking/grooming, the Peak Lodge and Umbrella bars, world class events like the World Cup, and summer mountain biking operations) have all contributed to the increased value of the area, the agents said. The new K-1 base lodge, which is scheduled to be completed this November, and any other future developments (both planned and speculated), are only going to continue to add to that value.

“I just think everything is kind of like jiving,” Williamson summarized. “I think it’s all of those things rolled into one that make Killington the place where people want to be. That’s going to continue,” he said.

But perhaps the biggest draw isn’t development at all, but rather the opposite.

“The general consensus is still that Vermont has the natural beauty, it has the outdoor activities that people want. That seems very consistent. People are still buying a house here because we have open space, fresh air and things to do outside. And I don’t think that’s Covid related anymore,” Mastroeni said. “Just like before Covid people were looking for that peace and quiet that New England has to offer. We have what people want. I think right now the biggest thing is we don’t have enough of it.”