By Polly Mikula

As soon as July, construction could begin on 24 new ski-in, ski-out townhouse duplexes at the Bear Mountain base area of Killington.

The gated community will feature two-story, 4-bedroom, 4-bath homes — each about 3,000+ square feet. They’ll have attached two-car garages, home offices, floor-to-ceiling windows and mountain views.

Prices begin at $2,050,000 and only seven reservations are still available. Prestige Real Estate, which has the exclusive listing for the townhouses, has secured the non-binding reservations for the right to enter into a purchase agreement, with a $10,000 fully refundable deposit for the others. Once Act 250 approvals are received, purchasers will have to sign a purchase and sales agreement and make a binding and non-refundable 20% cash deposit along with their financial qualifications.

Construction of the first phase of Base Camp homes is planned to begin in the summer of 2022 with the first completed homes debuting in the fall of 2023.

By fall 2024, the first phase of development will be complete (assuming no unexpected delays caused by permitting, supply chain or the economy), said Steve Malone, vice president of development and sales at Ottauquechee Realty Advisors, LLC, the developer for the Base Camp at Bear Mountain project.

“Right now we have all of the town of Killington site plan and PUD approvals and we have applied for all of our Agency of Natural Resources environmental quality permits, which include stormwater, potable water supply, things like that. And we have applied for the Act 250 permit,” Malone explained in an interview Friday, March 18.

A site visit and pre-hearing conference with the Act 250 commission is scheduled for April 29, at which point, interested entities can request party status for the Act 250 review.

“We’re hoping that the Act 250 permitting process ends sometime in early May that I would say May 15,” Malone ventured, adding, “like all other governmental agencies, they’re kind of backlogged.”

Once Act 250 permits are received, a flurry of activity will commence.

“Right now. We are looking at a construction start sometime around the middle of July. That’s what we’re anticipating based upon meetings with our contractors…They’re all lined up just waiting for the target date,” Malone said.

Purchasing the land and materials for the project will also commence upon Act 250 approval.

“[The contractors] won’t order material until the Act 250 permit is received,” Malone said, “and under our contract with Killington, we don’t take possession of the land until the Act 250 process is complete.”

What is Act 250?

“Basically what you’re doing when you do an Act 250 application, is you’re providing evidence in support of your project,” Malone explained. “So traffic impact studies, wildlife habitat reviews, letters from Rutland Regional ambulance and Green Mountain Power, etc. …. You have to assemble all that into a gigantic packet. The economic impact statement alone is, like, 100 pages long… So it’s very detailed,” he said.

Vermont’s Act 250 permitting process is more challenging than in other nearby states, Malone added. “It’s a little bit more rigorous than most other permitting jurisdictions. I’ve done a lot of work in New Hampshire. In New Hampshire, you go to the town, and you get your site plan approved. You go to the state and you get your environmental quality permits and you’re done. In Vermont, you start all over again. You have two public hearing processes.”

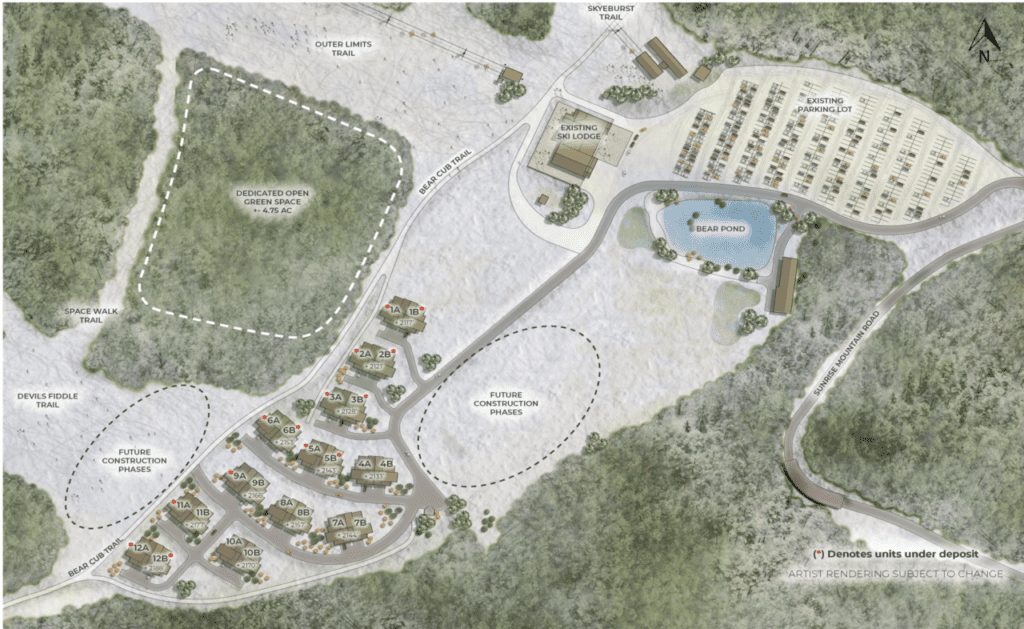

Base Camp at Bear Mountain is seeking a master plan approval for its three phases of development.

Phase 1 has a specific construction permit and allows for the 12 duplex buildings and all the related infrastructure. Phases 2 and 3 are unspecified.

“Phase 2 will be some other type of product, we’re not sure yet, it may be more townhomes. Or it may be multifamily is considered — constructed in what we call stack lots, like apartments, one level living on top of each other. We haven’t made a decision about that,” Malone explained. “The final phase will just be a couple of custom homes.”

Not all phases will require the same level of Act 250 scrutiny, however.

With a master plan approval, there’ll be specific “affirmative findings of fact” on some of the 10 criteria that future phases won’t have to redo, such as the traffic and wildlife habitat studies. But a specific site plan will have to be approved for each phase along with the Agency of Natural Resource permits for public water supply, wastewater, stormwater management, etc., Malone explained.

“It’s a much reduced process once you get the master plan approval,” he said. “Same goes for the town.”

Asked if he’s faced any objections from locals or neighbors to the project that could create an obstacle in the Act 250 process, Malone said there are none that he’s aware of, but quickly added: “You don’t know. You never know. I don’t think there is.”

While no one spoke up at the town’s public hearing about a year ago (April 15, 2021), party status for the Act 250 hearing will be requested at the pre-hearing April 29, and then any objections would be aired at the hearing that’s yet to be scheduled.

“The application has been deemed complete and a public warning for the pre-hearing was published this week, per statute,” he explained. “We have a very detailed, thorough application. But at this stage, it’s out of my control.”

Malone, however, does expect to have to clarify points of the application with the Rutland District Environmental Commission, which reviews Act 250 permit applications. The commission is made up of volunteer citizens appointed by the governor with staff support provided by five full-time district environmental coordinators located throughout the state.

“The way it works is invariably they will issue what’s called a ‘recess memo.’ There may be some points of clarification, you may need to submit additional evidence,” Malone said. “We might not get one, but every time I’ve done it, I’ve had a recess memo issued. You vet that out, and then they proceed to write the permits.”

Malone and Richard Saunders, his business partner of 25 years (“the finance guy”), are eager to get through this stage and to see construction get underway this summer.

“Richard and I are focused on getting this done,” Malone said.

The Base Camp at Bear Mountain planned community development will be constructed just off the Bear Cub Trail on the skier’s right a couple hundred yards before the Bear Mountain base lodge. Assuming all necessary permits are received in a timely fashion, construction could begin this summer.

Demographic shift, a new price point

When asked how he knew this project was right for Killington at this time, Malone explained that there were a variety of factors that have recently made Killington the perfect place to invest in such a development.

“What we’re seeing is, first of all, a demographic shift. The population in skiing has really been stagnant at about $11.5 million nationally, but we’re seeing that there’s an economic shift because it’s gotten to be more expensive,” Malone said. “Drive around Killington, now you see more high end vehicles at every restaurant. Last night I spent the night at the Mountain Lodge with Richard Saunders, my business partner, we went out and every place was packed, practically,” he said during the March 18 interview. “A year or two ago, it would not have been packed and it’s not peak season right now.”

In the past, Malone said, “Killington had in the industry what we call a low retention rate. In other words, there wasn’t a lot of loyalty to Killington. The numbers were still the highest on the East Coast, but not as high as they were 20 years ago when it hosted a million skiers. Now it’s coming back dramatically because Powdr has done the right thing,” he said. “No other mountain in the East has gotten the capital investment. And I know every mountain, I know just about every operator. I know what’s going on. Nobody has done what Killington has done. Nobody even comes close.

“What’s happening in Killington now is their retention rate is getting greater and greater. The loyalty factor is moving up. And people are buying restaurants and hotels and fixing them up. It’s a total renaissance over here. And it’s not happening anywhere else,” he said.

“With our project, we’ve created the new price point. But it’s reflective of who is coming into town. It’s one of those things where you look at the demographic shift here at Killington, because of the retention rate, there’s now a larger affluent body of people who can afford the price points that we’re putting out there with this product. You know, we’re over $2 million a unit now.”

That’s up from the initial offering of $1.8 million, but Malone doesn’t think the increase will affect reservations much.

“We do face the chance that maybe some people say, ‘Well, you know, I was in there for $1.8 million, now that it’s over $2 million, I don’t want to buy it’,” he said. “But I don’t think that’s going to happen, not from the people that we’re dealing with. I can tell you the profile of my buyers: they’re families (not everyone) but many are families of four. And the majority of them are in either high tech, or they’re fund managers. And they’re pulling down $2-$3 million a year in income.”

Heidi Bomengen, owner of Prestige Real Estate which has the exclusive listing to sell the Base Camp at Bear Mountain townhomes, said the buyers vary in their interest and intended use of the townhomes. “A couple are investors that intend to rent them, there’s some that are grandparents because the units are 4-bedroom, 4-bath and ski-in, ski-out which makes it really convenient for families who don’t always ski at the same time; are multi-generational. Each townhome is designed with two suites so you have one for the grandparents and the other for the parents each with a bathroom in the suite.”

One entire building is under deposit by one family (they bought two duplexes) and they plan to do a total custom home there. The buyer is a 38-year-old fund manager, Malone said.

Bomogen agreed with Malone that the price increase would not be a huge deterrent for these prospective buyers, but did say the delay in availability has impacted, and likely will continue to impact, conversion of the refundable deposits into contracts.

“It’s hard to tell,” she said. “I think we’ll lose some, mostly because it’s taking time to get them started and people have bought other things in the meantime,” she said, adding that she wasn’t at all worried. “We’ve already lost some people but we’ve resold them… you can’t get terribly upset about that. I think that when we actually have construction going on there’s going to be a whole other flurry. There’s just not many new developments.”

Seeing the demographic shift, Malone wanted to target his offerings as specifically as possible to meet new demands. He worked with Killington Resort to send an email survey to a select group from its database. About 120,000 Killington skiers and riders received the email blast.

“We got a really good response rate,” Malone said. Potential buyers “were interested in at least 50% occupancy for themselves. Because they can work from home. So now if they’re living in Saddle River, New Jersey or Wellesley, Massachusetts or wherever (my buyers come from all around) and they’ve been working at their home, they’re like, ‘Well, gee, I could be doing this up in the mountains in a year round environment for doing stuff outdoors with my family!’” he said.

“Now instead of having a second home in the mountains, it’s become their primary home and there’s now a trend where folks are looking to downsize their city residence,” Malone said. Families are “selling their big houses and moving to a transit location where there’s public transportation, like rail service into Manhattan,” he continued, by way of example, adding: “We’re also seeing that with the retirees that have moved up here… everyone is looking for lifestyle experiences, everything is experientially-oriented right now.”

‘Neighborhood of value’

This is not Malone’s first development in Killington. He constructed Topridge and The Lodges within Sunrise Mountain Village, both developed along the Sun Dog trail, from 1999-2005 and 2005-2008, respectively. The strategic timeline he employed creating those initial neighbors at Bear Mountain will be similar to the strategy he is using to build out the three phases at Base Camp.

“When I did Top Ridge we focused in on just building those big single family homes up there to establish a neighborhood of value. And then we launched the duplexes. So when duplex buyers were buying a duplex for $800,000 and they drove through a neighborhood of homes that were $3-$5 million, it was an easy proposition for them to understand. ‘I got a deal!’” Malone explained. “It’s kind of similar this time around, because when we do the next phases, they may be priced the same per square foot, but they’ll be smaller … So, again, it’s that proposition of neighborhood value. It’s the approach that we take.”