What COVID-19 and oil prices mean for your retirement account

By Patrick M. McGinn

As of last week, major market indices in the Americas, Asia and Europe have fallen more than 20% from recent historical highs. Globally declining investor sentiment and increasing pessimism have contributed to some of the sharpest intraday trading losses since 1987. Coupled with demand and supply shock concerns stemming from coronavirus, oil price wars have begun between Saudi Arabia and Russia.

We are officially in bear market territory.

As many have noticed, global tensions can have a serious impact on retirement accounts. For portfolios with increased exposure to equity, that could mean significant losses over the past several weeks. Individuals closer to retirement who deployed more conservative portfolios may have experienced less of an impact by utilizing allocations favoring fixed income.

Volatility is likely here to stay throughout the short-term across the majority of asset classes, including fixed income. The favorability of passive investment vehicles allowing investors to obtain broad market exposure has had a negative impact on most industry names, leaving us with nowhere to hide.

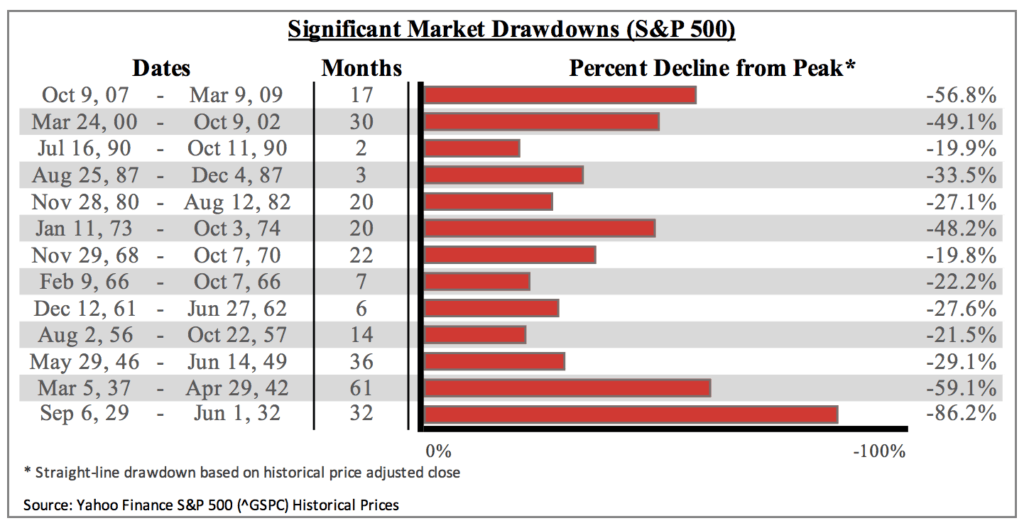

Historically, significant declines of this magnitude have lasted for two months or more. Based on the information below, major declines in the S&P 500 over the last 100 years have lasted 21 months and drawdown from peak -38.5% on average.

Leading indicators along with increased market activity preceding February began to point towards a mid-cycle cool down like those witnessed in 2012 and 2015. Panic stemming from COVID-19 and a subsequent oil price war decreased stock market asset valuations by over $7 trillion. Amid the panic is rational ideology that a significant decrease in consumer spending and increase in supply chain disruptions will continue throughout the next several months. As a result, many economists are forecasting negative GDP growth in the short and medium term. As supply shock for the production of goods is most likely temporary, consumer spending will be the main determinate of pain and length.

It is my belief that the current count of 3,600 coronavirus cases in the U.S. per the New York Times is drastically understated. As Federal and local governments implement changes to testing procedures and increase availability, I expect an exponential increase in the amount of reported cases over the coming weeks. This alone may incite another market sell off, driving down market valuations further.

Business closures may increase in both number and duration, significantly. In a market driven primarily by headlines, our pain may be far from over.

It is imperative during this time to avoid the temptation to engage in panic selling. Markets have previously experienced extreme volatility as seen above, yet still endured to reach new highs in following years. Although cautioned to resist the urge to act rashly, recent events should serve as a signal to take calculated action. It is time to reposition our potential for long-term growth, revisit investment allocations and focus on building a life events cash reserve.

Long-term growth potential

Keep in mind retirement accounts were designed for tax-advantaged savings over long periods of time. Balances that are currently down may increase as markets eventually recover. Avoid making hasty decisions driven by fear. Cashing out a retirement plan to preserve current valuations not only places future purchasing power in jeopardy, but can leave you with a hefty tax bill next year. Distributions from tax-advantaged retirement plans may be subject to ordinary income tax as well as a 10% early withdrawal penalty for individuals under age 59 ½. Ordinary income from retirement plan distributions also has the potential to force earned wages into higher tax brackets than would otherwise be the case.

It is not possible to drive your car forward while only looking in the rear-view mirror, but if historical events are an indication of future potential outcomes, look no further than the 2008 Financial Crisis. Investors who entered the market at historical highs in 2007 with the absolute worst timing prior to the collapse of markets would have realized a return of over 8% annually through December 2019. This includes the aforementioned drawdown from peak to trough of over -55%. Compounded returns have been a powerful tool for investors.

Revisit investment allocations

We should focus heavily on two main concepts, sustainability and diversity. It’s prudent to reallocate equity towards large name brands with superior balance sheets and ample free cash flow. If consumer demand remains low for an extended period of time, companies are better positioned to weather storms when they have access to surplus cash and the ability to access credit lines without over-leveraging. I am advising highly risk-adverse clients to avoid small to mid-sized firms, as they have historically demonstrated the strongest correlations of volatility to the ebbs and flows of cyclical demand. Due to the added element of a health pandemic, I would also avoid investments in the travel industry.

The introduction of fixed income in investor portfolios can soften dramatic swings in account value. Given signaling by the Federal Reserve, additional rate cuts could be on the way. I would target an average effective duration of less than four years. If rate increases are on the horizon in subsequent years when the economy recovers, longer duration fixed income positions may deliver negative total returns over the long-term holding periods. As poorly rated high yield bonds have struggled to outperform equities during up-markets and failed to provide protection during times of crisis, I do not advise holding them in order to increase fixed income returns.

This may also be a time to consider adding diversified buckets for retirement planning to provide guaranteed income throughout retirement through vehicles such as permanent life insurance or fixed annuities. As with all investment decisions, it is important to reevaluate your risk tolerance and determine if your portfolio is currently meeting those objectives.

Build a life events cash reserve

Cashing out positions in a portfolio during market drawdowns significantly reduces your ability to regain your footing as markets recover. Maintaining a life events fund is crucial to the success of any financial plan in order to absorb the potential impact from injury, job loss, or economic downturn. If you do not already have a life events fund, or it is inadequately funded, this may be the time to start building one. Common sense financial planning best positions clients for long-term success when it focuses first on variables you can directly control, such as a healthy savings rate and responsible cash flow management.

There is no way of determining when markets will hit bottom, as no model exists for the current pandemic. This is truly a black swan event. However, there are steps you can take today to hedge future volatility and implement common sense financial planning that not only suits your goals, but also your risk tolerance.

Market Commentary Disclaimer: This publication is for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. The information contained herein is the opinion of Highline Financial Management and is subject to change at any time based upon unforeseen events or market conditions.

Patrick M. McGinn is a founder and financial Planner at Highline Financial Management. He lives in Killington.